What should you do when both stocks and bonds fall?

This article talks about the steps to take in the current market scenario when stocks and bonds are falling simultaneously.

This article talks about the steps to take in the current market scenario when stocks and bonds are falling simultaneously.

The typical 60/40 equity-to-debt allocation, a standard recommendation for long-term portfolios everywhere, including ours, is currently under a unique threat. The portfolio assumes a mix of stocks and bonds, usually invested via equity and debt mutual funds, that provides growth and stability via the premise that in most cases, both of these assets will not be down at the same time. However, today that is not the case.

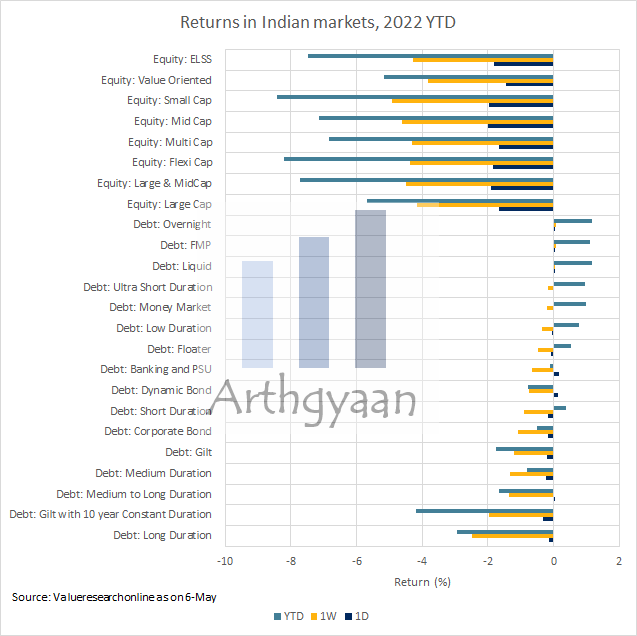

Inflation fears are causing central banks worldwide to raise interest rates. The recent rate hikes by the US FED and India’s RBI on 4th May 2022 are expected to be the first in a long line of upcoming rate increases. While the impact on home loan and other loan rates are expected to be gradual, there was an immediate reaction in the debt market, with debt fund NAVs falling across the board. This happened while equity funds are trading a lot lower than their October 2021 peaks.

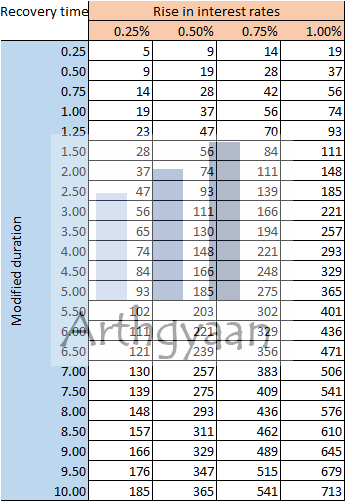

When interest rates rise, new bonds that pay higher coupons are more desirable than older bonds with lower coupons. This is the reason why debt fund NAVs fall when rates rise. Also, the longer the bond’s maturity, the higher the interest it has to offer, and hence higher the fall when rates rise.

As the above table shows, depending on their maturity profile, debt funds will take different amounts of time to recover. As new bonds come into the market and enter bond funds, the yields and NAVs will go higher. The first funds to react positively will be overnight funds, followed by liquid and money markets. Gilt and other high-duration funds will be the last to respond.

Equity valuation depends on using the company’s cost of capital to discount its future cash flows using a calculation called Discounted Cash Flow (DCF). Since interest rates go into the denominator, DCF values decrease with rising interest rates. As interest rate rises, stoked by inflation fears, globally get priced into equity markets, they have been falling continuously since the highs of October 2021.

Investors should be able to use our comprehensive goal-based investing calculator to review their portfolios and rebalance to maximize their chances of reaching their financial goals.

Equity funds: Investors should continue investing as per their current investment plan. This fall is an opportunity to rack up units at lower NAVs that will be beneficial once markets recover as we show here: Don’t stop investing when the markets are down.

Debt funds: Investors should continue to invest in lower duration, high-quality bonds in the liquid and money market category in line with our guide on choosing debt funds: How to choose a debt mutual fund?

Suppose you are holding longer=duration funds and are spooked by the fall. In that case, you should understand that the higher exposure to interest rate risk has the potential for highly positive and negative returns depending on the current stage of the interest rate cycle. Having an active gilt fund manager is one way to invest in gilt funds.

Instead of active, if you invest in constant maturity gilt funds, you should know about and be comfortable with the higher level of interest rate risk. An active fund manager can change the fund’s maturity profile as the rates change. However, a constant maturity fund can invest only a single type of bond and cannot change its duration risk.

If you are still uncomfortable, switch to lower-maturity funds.

All investors should consider rebalancing as per their asset allocation if their equity-to-debt allocation drifts by more than 5%. Read more here on rebalancing: Portfolio rebalancing during goal-based investing: why, when and how?

Retired investors should look forward to higher accruals from their debt investments due to the rising rates. That is the only good news out of this story. However, since their entire portfolio will be down if they have invested in mutual funds, it will be good to review their expenses for the next few months to avoid drawing down from a down portfolio. If not already done, retirees should implement a bucket-based retirement portfolio to ensure their following few years’ expenses are kept safe in cash-type investments. This way, they do not have to withdraw from market-linked investments at the wrong time.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What should you do when both stocks and bonds fall? first appeared on 08 May 2022 at https://arthgyaan.com