Gilt funds do not always go up in value. Should you invest in gilt funds?

This article explains if Indian investors should consider investing in gilt or government securities mutual funds for their goals.

This article explains if Indian investors should consider investing in gilt or government securities mutual funds for their goals.

Gilts or government securities are issued by the Central (or State) Government to fund government activities like infrastructure, defence, education or anything that requires funding as per the Union Budget.

These bonds are issued at various maturities:

The RBI issues gilts in India via a regular auction process.

Retail investors can invest in gilts in two ways:

This article discusses the second option and explains what investors should know while investing in gilt mutual funds.

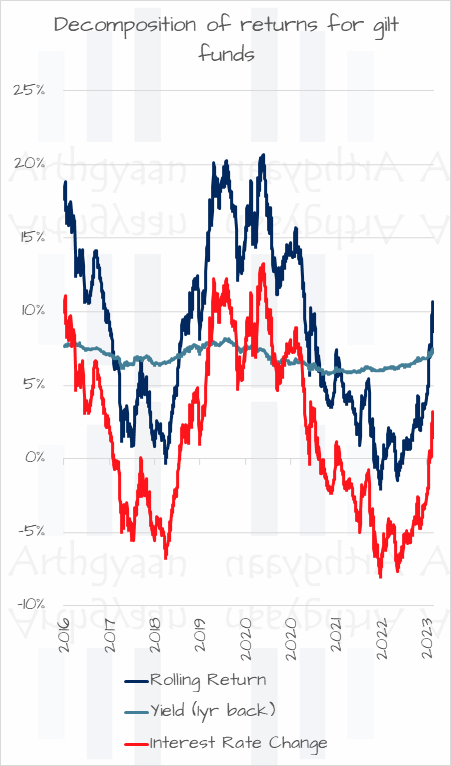

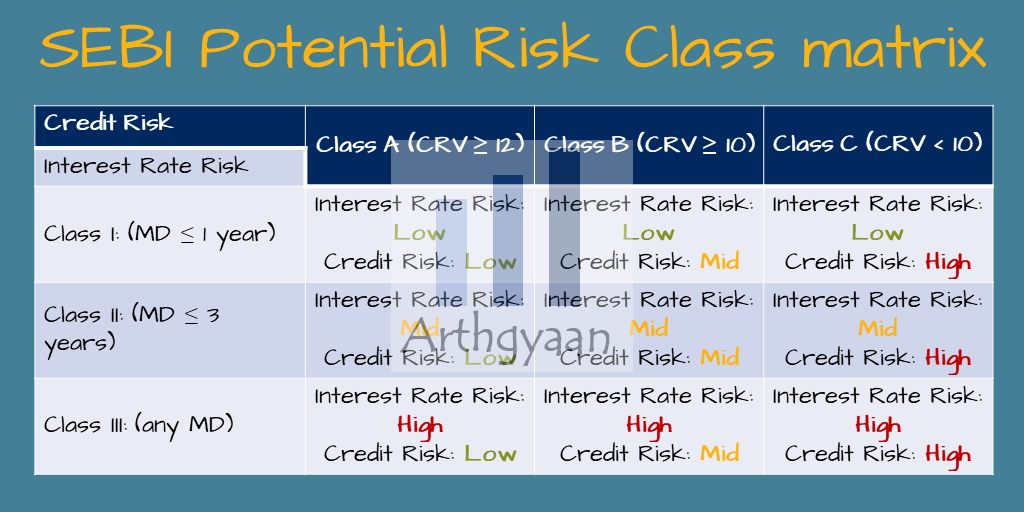

As the decomposition shows in the above chart, there are two sources of return in a gilt fund:

Of these, the first one talks about credit quality. Since the government is the borrower of the money, there is zero risk that the government may be unable to pay back the interest and the principal. Therefore there is no credit risk. However, there is a risk in interest rate movements.

Consider an existing bond offering a 7% coupon rate versus a new bond with a 6% coupon. The current bond is more desirable, and the NAV of the debt fund holding it will be higher since the 7% bond is more valuable due to the higher coupon. Similarly, the reverse happens, i.e. debt fund NAVs fall if interest rates rise in the economy.

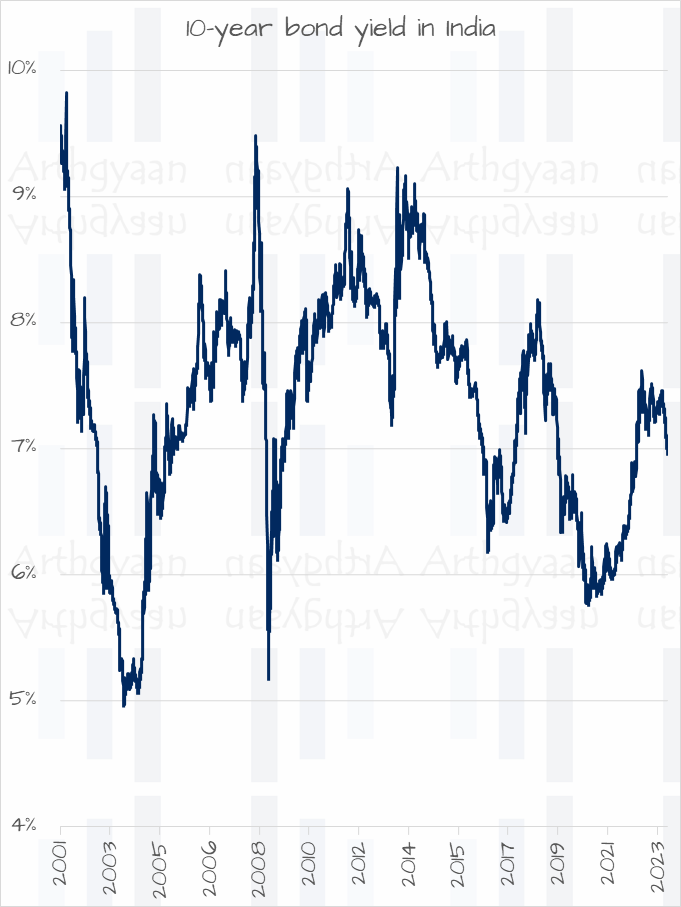

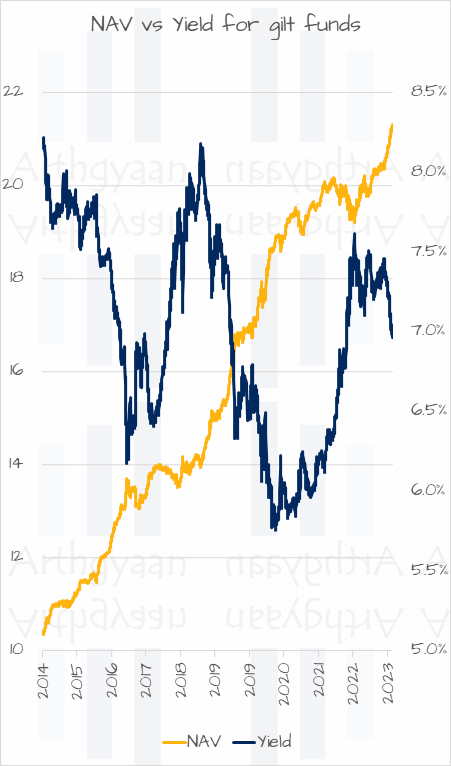

The chart above shows that bond yields fluctuate significantly due to economic factors.

The metric for measuring interest rate risk is Modified Duration. It is available for all debt funds (higher the average portfolio maturity). It measures the portfolio NAV rate of change due to changes in interest rates.

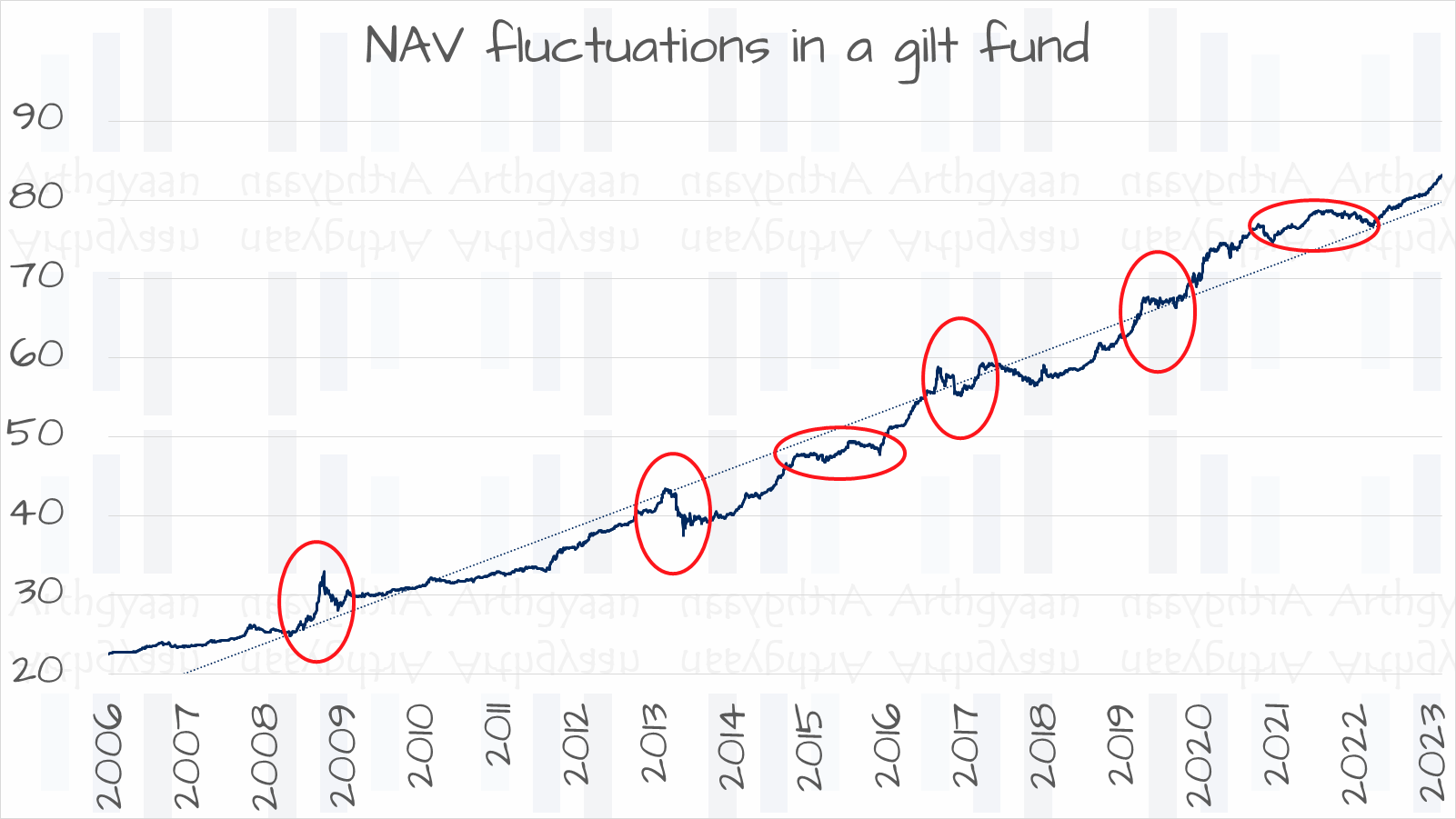

As the chart shows above, there is quite a bit of fluctuation in the NAV movement of gilt funds that investors should be mindful of.

The graph has a long-term upward trend (dotted blue line). Still, there have been many periods with sharp rises, falls and even sideways movement in the NAV, as shown in red ovals. These characteristics mean that gilt funds have similar movement characteristics to equity funds but are less intense in both rises and falls.

The chart above compares the NAV movement of a 10-year constant maturity gilt fund and the yield movement of the 10-year bond in India. The 10-year constant maturity gilt fund invests only in the 10-year maturity bond or in an equivalent portfolio of bonds with similar interest rate risk exposure. The critical takeaway is that fund NAV moves in the opposite direction as interest rates.

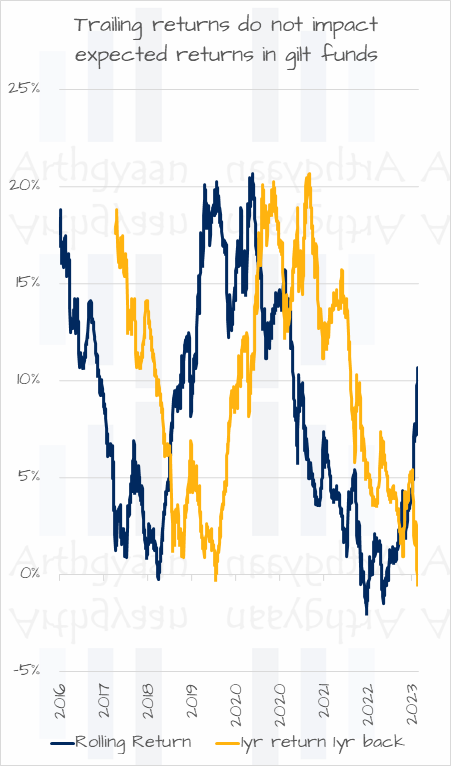

One of the critical mistakes that investors make is to consider past performance for determining the future performance of mutual funds. Unfortunately, gilt funds are not an exception to this rule.

As the chart above shows, there is no practical correlation between past and forward returns since the maximum impact, as the decomposition chart above displays, comes from movements in interest rates.

In 2020, these funds gave huge returns due to falling rates but ran the risk of significant losses when interest rates rose as they did in 2022. Therefore, investors should continuously monitor interest rates and asset allocation if they invest in Gilt funds. However, the investor can accept the volatility of interest rate movements and rebalance as per their plan. In that case, Gilt mutual funds can be considered if the goal horizon is 10 years or more.

The recent (2019, 2020) high returns of gilt funds are due to falling interest rates abruptly reversed in 2022 and lead to heavy losses. Since short-term interest rates can be volatile, so can gilt fund NAVs.

Recent returns of debt funds do not predict future returns in any way, it is up to the investor’s risk appetite to try to profit from this volatility or avoid this category altogether. This is the guide for choosing such debt mutual funds: How to choose a debt mutual fund?.

In a future article, we will cover

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Gilt funds do not always go up in value. Should you invest in gilt funds? first appeared on 04 Jun 2023 at https://arthgyaan.com