Mutual fund report card: Kotak Gilt Fund

This article shows the historical performance of this fund as an example of a long-running gilt fund to demonstrate the risk and return in a gilt fund.

This article shows the historical performance of this fund as an example of a long-running gilt fund to demonstrate the risk and return in a gilt fund.

Kotak Gilt Fund is a gilt fund. Please read our primer on gilt funds here before proceeding: Gilt funds do not always go up in value. Should you invest in gilt funds?

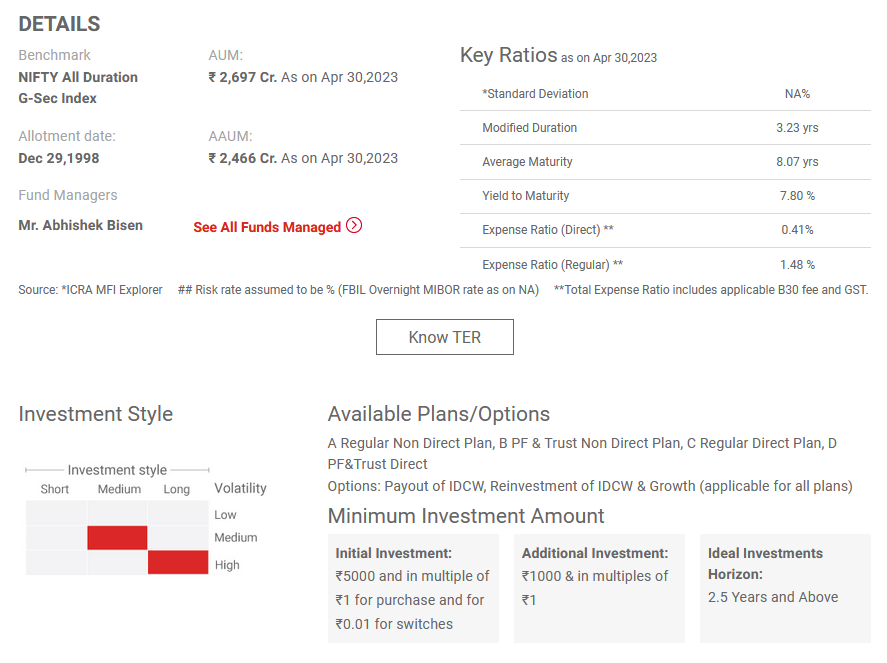

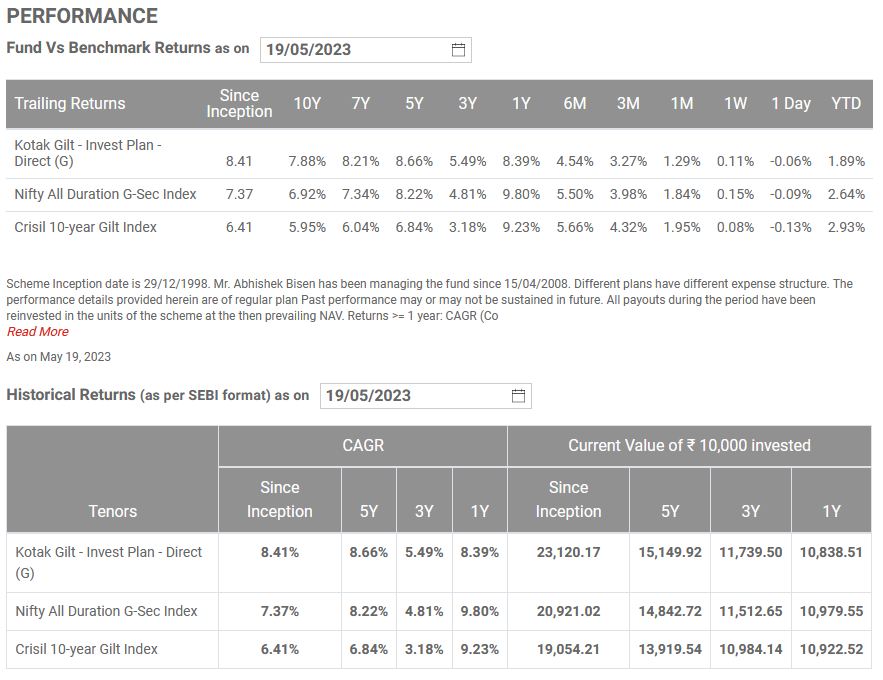

Data for this section is from the website of Kotak Gilt Fund as on 19-May-2023. The link is here.

This fund invests primarily in long-term gilts issued by the Central government and has existed since 1998. The fund is benchmarked against the Nifty All-Duration G-Sec index.

Investors should note that the fund has beaten the benchmark for the direct plan. In contrast, the regular plan (performance figures here) has not due to the extra 1% TER.

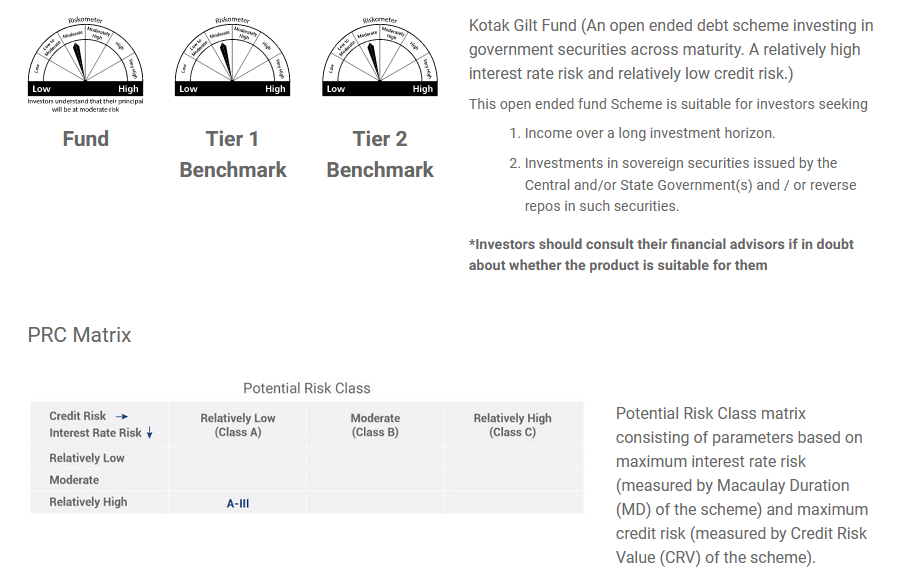

As per the Potential Risk Class (PRC), this section shows that the fund has considerable interest rate risk, which we will explore next. Read more on PRC here: How to use the SEBI Potential Risk Class matrix to understand risk in debt mutual funds?

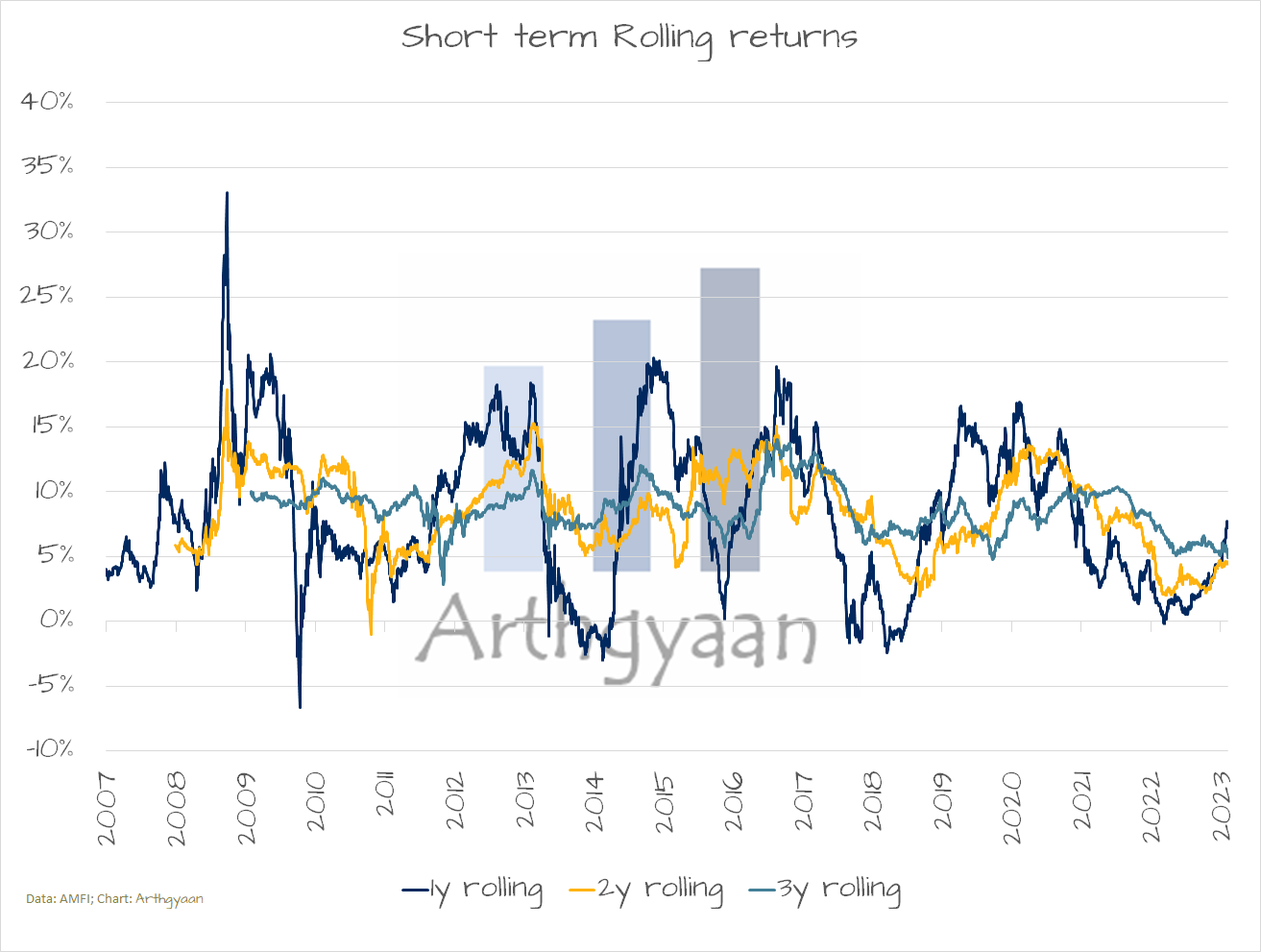

Data for this section is from the AMFI website for Kotak Gilt Fund as on 19-May-2023.

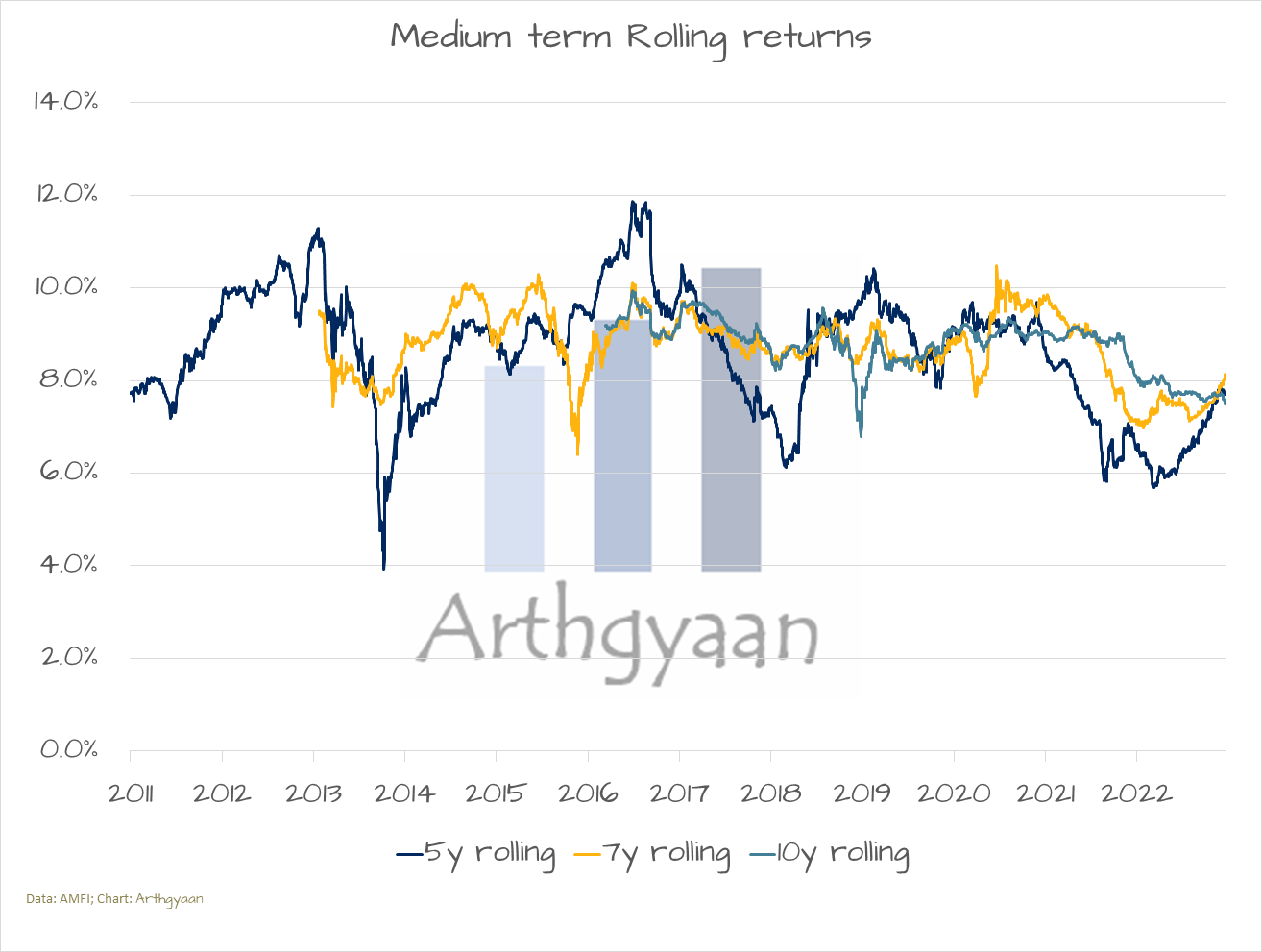

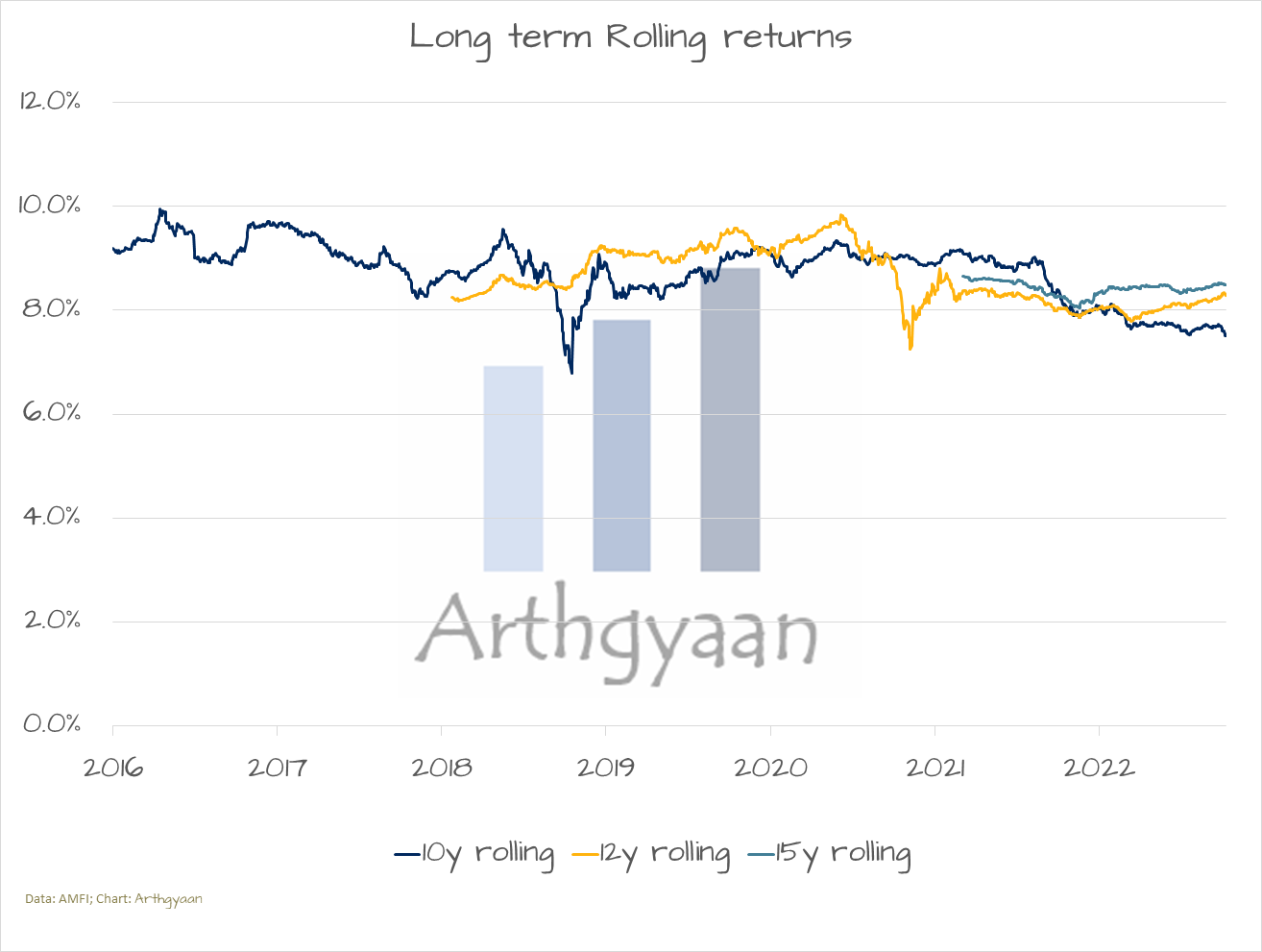

We calculate rolling returns for multiple holding periods to see the maximum and minimum returns over different holding periods.

Short-term Rolling returns

Medium-term Rolling returns

Long-term Rolling returns

As the charts show, beyond a 2-year holding period, a one-time investment in this fund has yet to lose money.

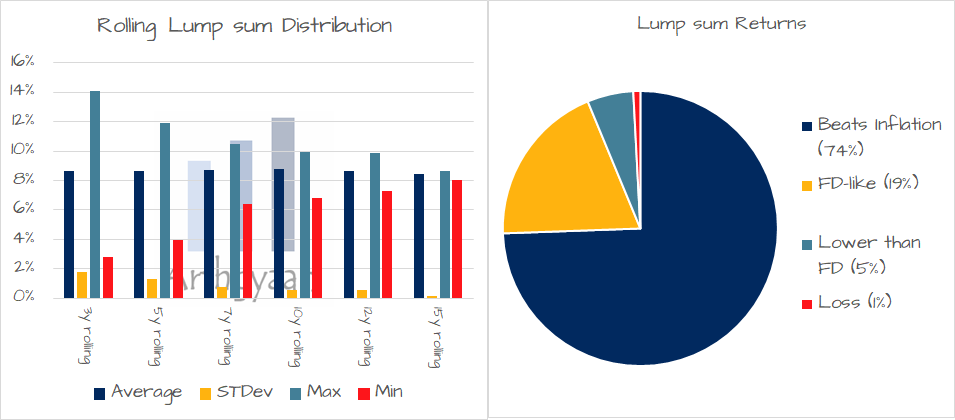

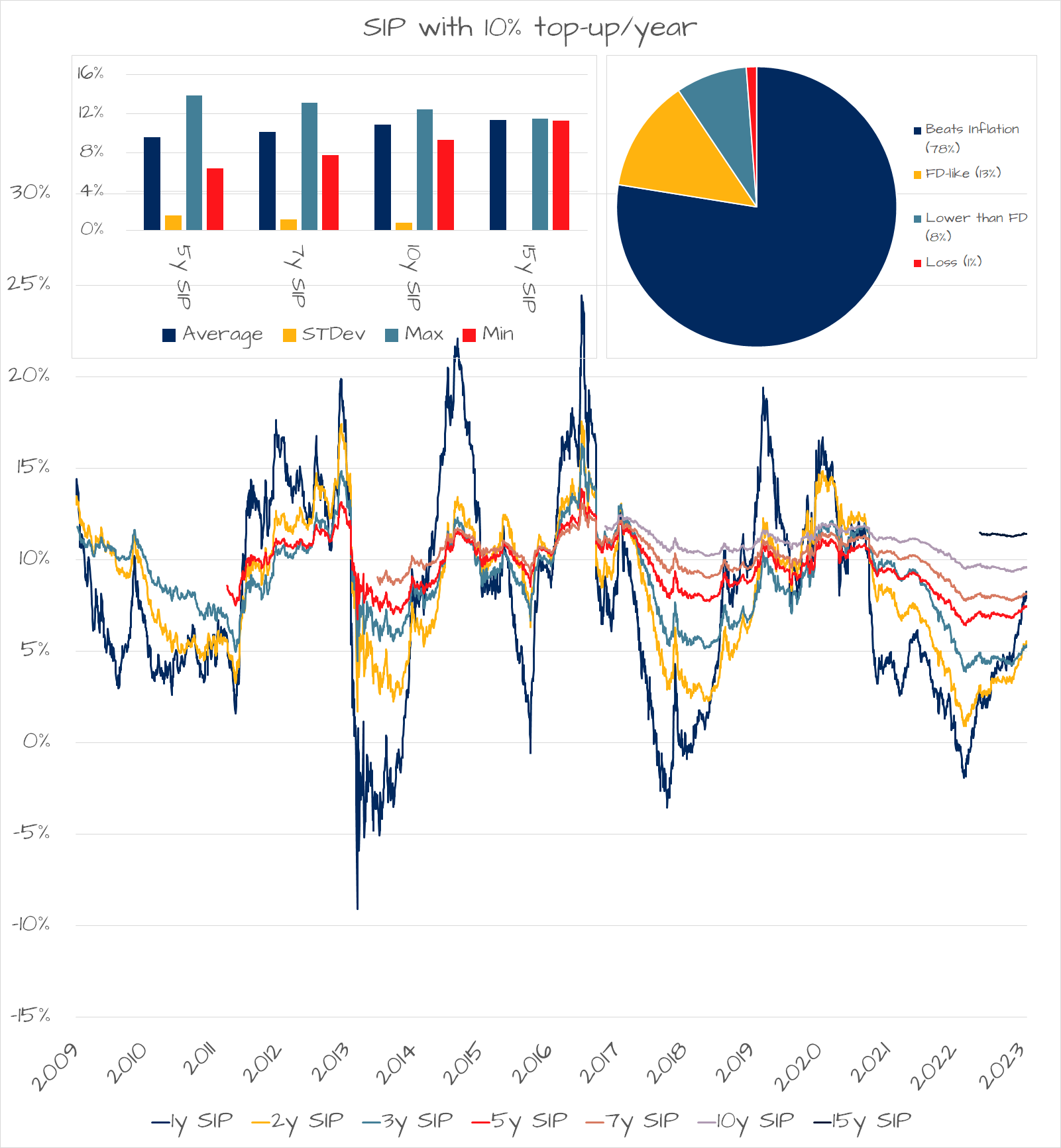

We combine all the different holding periods and check the average, maximum, minimum and dispersion (measured via standard deviation). We see that as the holding period increases:

We have also counted the cases where the fund has beaten inflation (8%) and FD rates (7%) over this period in the pie chart. The only instances where there was a loss were for holding periods shorter than 3 years. Such losses, which are a manifestation of interest rate risk, occur when interest rates rise.

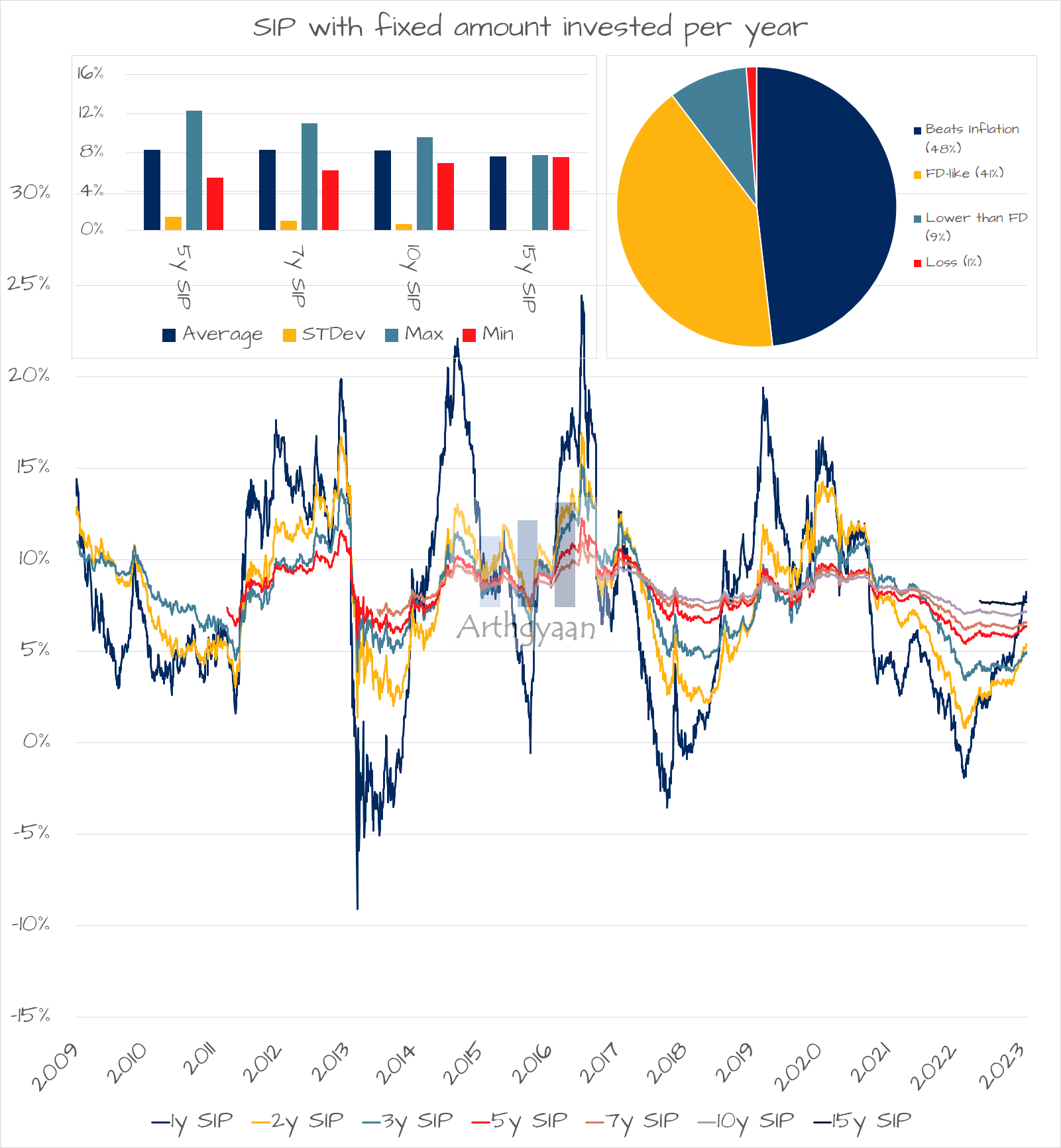

Now we will see how SIP investments, one fixed and one 10% yearly top-up, have performed.

We see similar trends with increasing the investment holding period for an investment made monthly in SIP form. Interestingly the top-up SIP returns are higher than the fixed SIP due to significant interest rate decreases in the economy in the last few years.

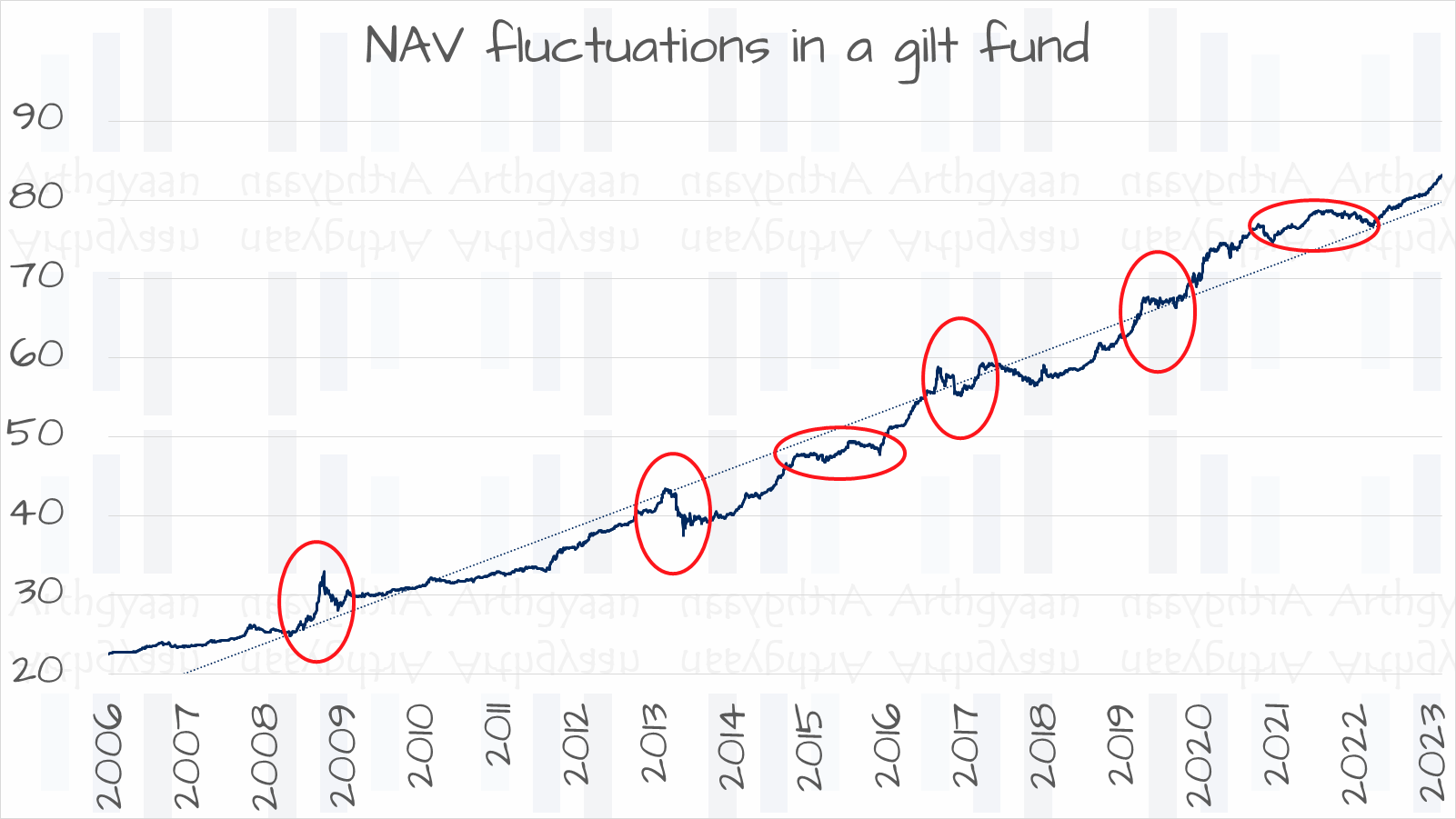

As the chart shows above, there is quite a bit of fluctuation in the NAV movement of gilt funds that investors should be mindful of.

The graph has a long-term upward trend (dotted blue line). Still, there have been many periods with sharp rises, falls and even sideways movement in the NAV, as shown in red ovals. These characteristics mean that gilt funds have similar movement characteristics to equity funds but are less intense in both rises and falls. As we have seen above, these funds are unsuitable for short-term investments, whether as a lump sum or in SIP form.

The key here is to combine this gilt fund and similar ones with both equities and short-duration debt funds to create a diversified portfolio. We will cover the concept in a future article.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Mutual fund report card: Kotak Gilt Fund first appeared on 07 Jun 2023 at https://arthgyaan.com