Calculator: UPS vs. NPS - which is better?

This article shows how to determine if an NPS subscriber should switch to the newly announced Unified Pension Scheme from April 2025.

This article shows how to determine if an NPS subscriber should switch to the newly announced Unified Pension Scheme from April 2025.

Originally published: 26-Aug-2024

Updated: 24-March-2025 - updated with details from Gazette Notification

The Unified Pension Scheme (UPS) was announced on 25th August 2024 to “improve the National Pension System (NPS) for Central Government employees.” UPS offers:

The last point, since UPS is opt-in while NPS is mandatory, requires some calculation to determine if UPS is better than NPS.

You can use this calculator to find out.

We will follow these rules:

The best option (NPS or UPS) is the one that, while following these rules, leads to a lower investment amount today. It is important to understand that UPS shifts most of the market risk in retirement from the retiree to the government since:

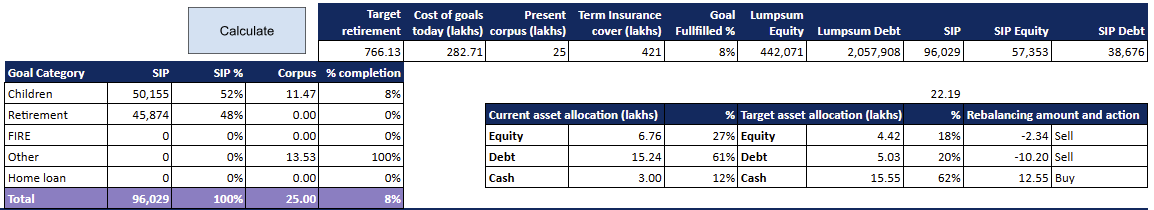

The Arthgyaan goal-based investing calculator shows how to determine if it makes sense to switch to the UPS from NPS. We have a sheet “pension-in-retirement” that allows you to see which is better: no pension (i.e., NPS not started yet), NPS, or UPS.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

We will assume that the investor is a 38-year-old Central Government employee with ₹25 lakhs in NPS and another ₹25 lakhs invested in other assets. The employee has goals for the family and child:

| Goal | Amount (₹ lakhs) | Years |

|---|---|---|

| Family Goals | ||

| Car | 7 | 3 |

| Foreign Vacation | 5 | 5 |

| Child Goals | ||

| School admission | 2 | 1 |

| School trip | 2 | 9 |

| UG: Admission + Year 1 | 9 | 14 |

| UG: Year 2 | 7 | 15 |

| UG: Year 3 | 7 | 16 |

| UG: Industrial Training + Year 4 | 8 | 17 |

| PG: Admission + Year 1 | 15 | 19 |

| PG: Year 2 | 10 | 20 |

| Down-payment of home | 30 | 21 |

| Marriage | 15 | 27 |

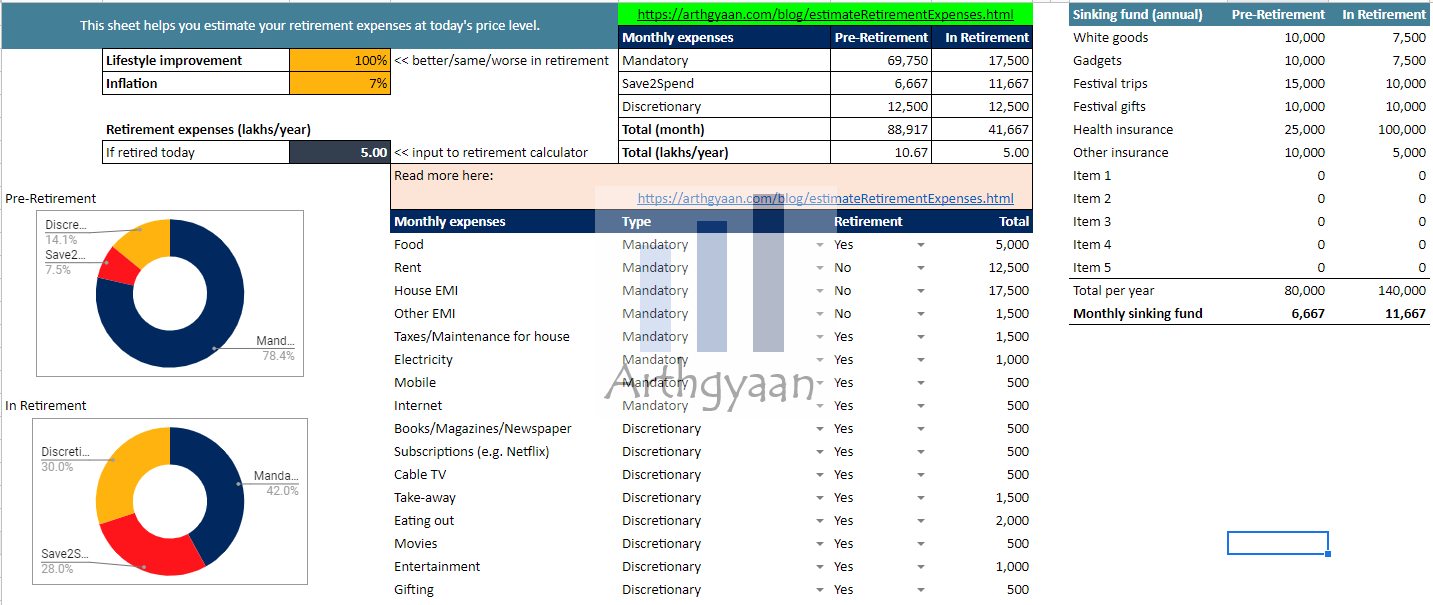

Apart from these, the employee is targeting retirement starting 22 years from now with an annual expense of ₹5 lakhs (see “expenses-in-retirement” tab) in today’s money.

Other assumptions are as follows:

| Item | Assumption |

|---|---|

| Inflation | 7% |

| SIP Increment | 10% |

| Years to retirement | 22 |

| Average Equity return post-tax | 11% |

| Average Debt return post-tax | 4% |

| Earning years left | 22 |

| Years in retirement | 40 |

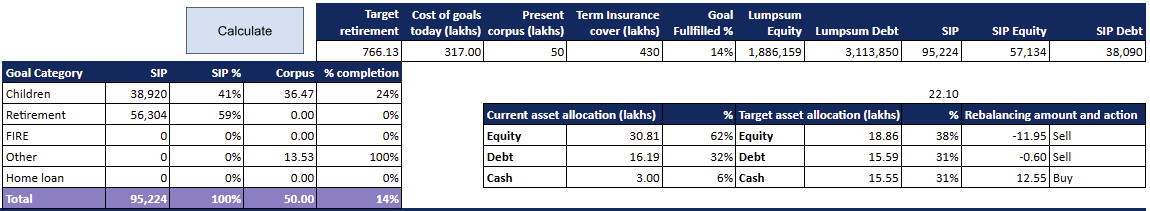

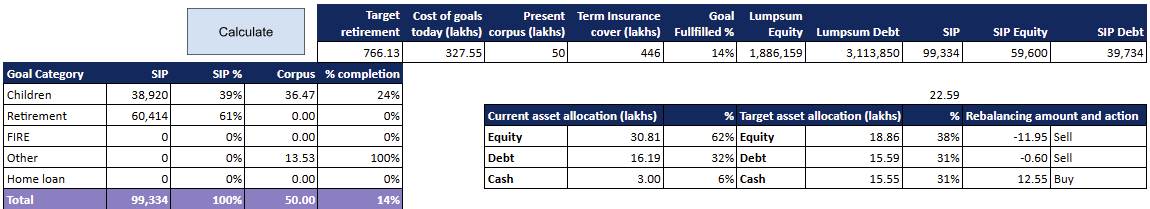

In the base case, we do not have NPS at all, and the entire portfolio is held outside NPS. Then we add ₹25 lakhs of NPS and later switch to UPS. To make an apples-to-apples comparison, we ensure that the NPS and UPS pensions (starting value, as the UPS one increases over time) are the same:

The summary of these cases is shown below:

| Metric | Base | UPS | NPS |

|---|---|---|---|

| Target retirement corpus (lakhs) | 766.13 | 766.13 | 766.13 |

| Cost of goals today (lakhs) | 317.00 | 282.71 | 327.55 |

| Present corpus (lakhs) | 50.00 | 25.00 | 50.00 |

| Term Insurance cover (lakhs) | 430.00 | 421.00 | 446.00 |

| Monthly total SIP | 95,224 | 96,029 | 99,334 |

| Retirement-only SIP | 56,304 | 45,874 | 60,414 |

| Other goal SIP | 38,920 | 50,155 | 38,920 |

Here

We cannot generalise the cases as it will depend on the current value of the NPS corpus and the other goals to be met by the portfolio.

“There ain’t no such thing as a free lunch” is an expression that speaks to the idea that everything ultimately has a cost and nothing is truly free. - Investopedia

As prudent observers of capital markets, it should be considered risky for the government to assume a considerable amount of market risk related to pension payments. Any NPS subscriber looking to switch to the UPS should understand that at the end of the day, any government scheme carries a significant amount of policy-change risk. Given that retirement is a multi-decade journey, and the government controls inflation and interest rates to a certain extent, a guaranteed pension scheme can easily turn sour for retirees depending on market performance.

The Unified Pension Scheme (UPS) is a new pension scheme being introduced by the Indian government for central government employees who joined service on or after January 1, 2004. It serves as an alternative to the National Pension System (NPS). The UPS will be implemented from April 1, 2025.

UPS differs from NPS in several key aspects. Firstly, UPS is exclusively for government employees, while NPS is available to both government and private sector employees. Secondly, UPS offers a guaranteed minimum pension of ₹10,000 after 10 years of service, with a fixed payout of 50% of the average basic pay of the last 12 months before retirement after 25 years of service, while NPS pension is market-linked with no guaranteed amount. In UPS, the government contributes 18.5% of the basic pay plus Dearness Allowance (DA), while in NPS, it's 14%. UPS provides medical benefits and is linked to Dearness Relief (DR) for inflation adjustment, which NPS lacks. Furthermore, UPS provides a lump sum payment in addition to gratuity upon retirement, unlike NPS. Finally, employees who chose NPS cannot later switch to UPS.

Key benefits of the UPS include: a guaranteed minimum pension of ₹10,000 per month after 10 years of service; an assured pension of 50% of the average basic pay of the last 12 months before retirement, after 25 years of service; inflation-linked pension through Dearness Relief (DR); an assured family pension of 60% of the employee's pension; medical facilities; and a lump sum payment at superannuation.

Under UPS, employees contribute 10% of their basic pay plus Dearness Allowance (DA). The government contributes 18.5% of the employee's basic pay plus DA. This contribution is split into two funds: one, an individual corpus with employee and matching government contribution and two, a pool corpus with the remaining government contribution. The employee can only make investment decisions for their individual corpus.

UPS offers inflation protection by linking pensions to Dearness Relief (DR). The pension will be adjusted according to the All India Consumer Price Index for Industrial Workers (AICPI-IW), ensuring that the pension keeps pace with the rising cost of living. This benefit is not available under NPS.

Government employees who are currently enrolled in NPS will have the option to switch to UPS, however, those who have already chosen UPS cannot switch back to NPS again. The new scheme is also available for those who have superannuated from the NPS before the implementation date of UPS. Such employees will be paid arrears with interest as per the Public Provident Fund rates.

In the event of the death of the pensioner, the legally wedded spouse will be entitled to a family pension, calculated as 60% of the pension that was admissible to the employee before their demise. This family pension is also indexed to inflation via Dearness Relief.

The decision depends on individual circumstances and risk tolerance. Employees who prefer a guaranteed pension with inflation protection and medical benefits might find UPS more suitable, especially if they have less than 10-20 years of service left. Those with equity market knowledge and a longer service period could consider NPS for potentially higher returns. However, even with NPS, it's necessary to check if the annuity plus systematic withdrawals from the remaining corpus will match the kind of pension that can be expected from UPS. Personal circumstances and a holistic view, including other investments, need to be considered along with a careful use of a calculator which considers all the conditions and variables. The Arthgyaan goal-based investing calculator can help you calculate which is better: UPS or NPS.

Employees can choose to switch to UPS or remain in NPS. Once UPS is chosen then they cannot come back to NPS

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Calculator: UPS vs. NPS - which is better? first appeared on 26 Aug 2024 at https://arthgyaan.com