Budget 2025: how retirees can pay zero tax on a 5 crore fixed deposit portfolio with risk-free 2 lakh per month income

This article describes the tax benefits announced in Budget 2025 applicable to retirees and other fixed-income investors.

This article describes the tax benefits announced in Budget 2025 applicable to retirees and other fixed-income investors.

This article is a part of our detailed article series on Union Budget 2025. Ensure you have read the other parts here:

This article gives a high-level overview of the most important points which affect your portfolio and taxation in Union Budget 2025 for both residents and NRIs.

This article describes the tax benefits announced in Budget 2025 that can be used by NRIs planning to retire in India to create a tax-free and inflation-indexed passive income stream.

This article describes the tax benefits announced in Budget 2025 for the NPS Vatsalya Scheme to understand if these benefits make NPS Vatsalya a good scheme for children’s future.

This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2025.

Budget 2025 declared that any income below ₹12.75 lakhs (₹12 lakhs plus ₹75,000 standard deduction) will be tax-free in the new tax regime. However, the standard deduction of ₹75,000 is available only for salary and pension income. For retirees without salary and pension, the ₹12 lakhs exemption from dividends, interest, rent and bonds coupon offers a significant benefit which we will now cover.

This declaration opens up the opportunity for higher tax-free income for retirees, senior citizens and early retirement (FIRE) aspirants who can now plan for a higher allocation towards assets producing income under ordinary tax rates.

As per Budget 2025 (as announced on 1-Feb-2025),

Old tax Regime slabs for post-deduction income are:

New tax Regime slabs for post-deduction income are:

Note: The new tax regime slabs are as of Union Budget 2025 announced on 1-Feb-2025. Standard deduction is at ₹75,000 (same as Budget 2024) for income from salary and pension. Please keep in mind that offset of capital gains say under Section 111A, 112 etc (stocks and mutual funds) will not be available in the amounts above the threshold 4L no-tax threshold.

This means that income up to ₹12.75L (including the standard deduction) will be tax-free but if you have say ₹3 lakhs of equity long-term capital gains, it will still be taxable at 12.5% above 1.25L. Though taxable income starts after 4 lakhs as per the slabs, there is no tax until ₹12.75lakhs (₹12 lakhs for non-salaried) due to marginal relief.

There is also a concept of marginal relief, under Section 87A, up to ₹71,250 so that some one with ₹12,75,001 income is not hit with ₹71,250 tax just because of being over the threshold by ₹1. In Budget 2025, 87A relief has been raised to ₹60,000 for income up to ₹12 lakhs. 87A rebate is not available for NRIs.

Previous to Union Budget 2025, the new regime slab rates were:

₹12.75 lakhs per person is tax-free. If this income comes from a portfolio offering an average of 5% income from interest, rent, coupons and dividends, then each investor can hold

12 / 5% = ₹2.4 cr assets tax-free

For spouses, this amount doubles to ₹4.8 crore and the monthly income is ₹12 * 2 / 12 = ₹2 lakhs. This income is completely safe since most of the big banks offer long-term FDs above 5%. You don’t have to actively look for banks with dubious track records to get 5% from FDs.

It should be kept in mind that capital gains, from stocks / Mutual funds / Real estate etc. are not a part of this tax-exempted limit. For example, if you have interest income and capital gains of ₹10 lakhs each, then the interest income is tax free but the capital gains will be taxable at specific rates from 10%-30% or slab rates above the basic ₹4L exemption limit.

We can generalise the calculation to find out how investors investing either singly or as a couple can allocate their portfolio to these investments and still pay no tax in FY 2025-26:

| Interest rate | Per person | Two spouses | Investments |

|---|---|---|---|

| 1.0% | 12.00 | 24.00 | Rent |

| 1.5% | 8.00 | 16.00 | Rent, Dividends |

| 2.0% | 6.00 | 12.00 | Above plus savings interest |

| 2.5% | 4.80 | 9.60 | –’’– |

| 3.0% | 4.00 | 8.00 | –’’– |

| 3.5% | 3.43 | 6.86 | –’’– |

| 4.0% | 3.00 | 6.00 | –’’– |

| 4.5% | 2.67 | 5.33 | –’’– |

| 5.0% | 2.40 | 4.80 | Above plus FD interest |

| 5.5% | 2.18 | 4.36 | –’’– |

| 6.0% | 2.00 | 4.00 | –’’– |

| 6.5% | 1.85 | 3.69 | Above plus Bond coupon |

| 7.0% | 1.71 | 3.43 | –’’– |

| 7.5% | 1.60 | 3.20 | –’’– |

| 8.0% | 1.50 | 3.00 | Above plus SCSS interest |

| 8.5% | 1.41 | 2.82 | –’’– |

| 9.0% | 1.33 | 2.67 | –’’– |

| 9.5% | 1.26 | 2.53 | –’’– |

| 10.0% | 1.20 | 2.40 | –’’– |

Note: Beyond 7%, it becomes increasingly difficult to create a stable income stream via fixed-income investments only. All values beyond 7% are for reference only and should not be considered practical.

In the table above, a couple with around ₹10 crores invested half in the name of each spouse investing in a mix of rental income and dividends at 2.5% will make ₹24L/year (or ₹2 lakhs/month) and still pay no tax.

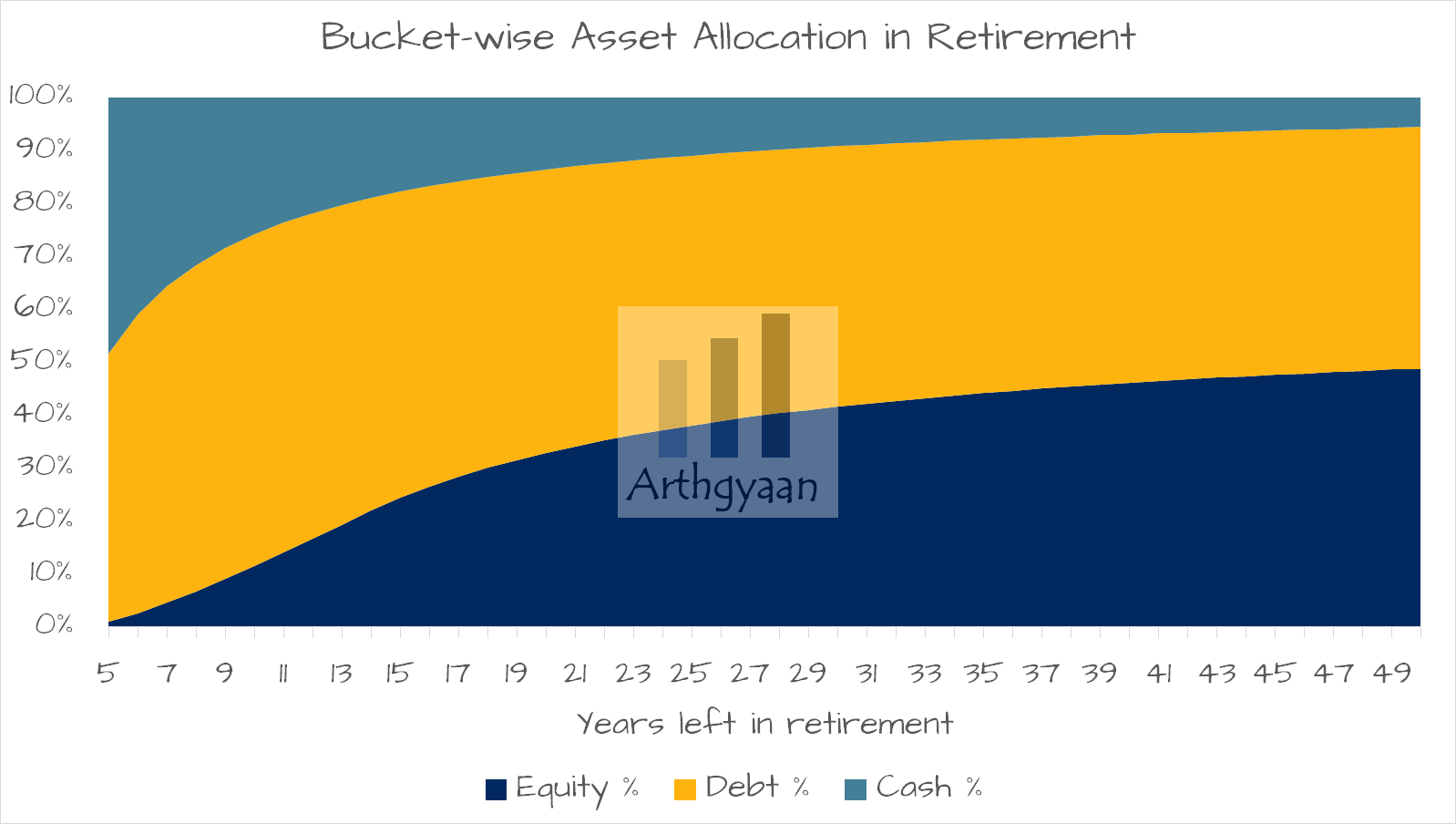

Interest-bearing investments form a part of Bucket 2 of a retirement portfolio for both normal and early (FIRE) retirees.

The concept of the 3-bucket retirement portfolio creates three risk-based asset pools or buckets within the retirement portfolio:

Using the table above allows us to know at a glance the maximum that can be allocated to Bucket 2 to generate enough income to feed Bucket 1 (and day-to-day expenses) and yet minimise tax.

Ultimately, the retiree portfolio will look like the chart above, with each bucket changing over time as retirement progresses. Any excess income from Bucket 2 will be taxable.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Budget 2025: how retirees can pay zero tax on a 5 crore fixed deposit portfolio with risk-free 2 lakh per month income first appeared on 01 Feb 2025 at https://arthgyaan.com