NSE IFSC: trade in US stocks from your Indian broker account

A recent innovation by the NSE now allows resident Indians to buy US stocks directly from broker accounts. Should you invest?

A recent innovation by the NSE now allows resident Indians to buy US stocks directly from broker accounts. Should you invest?

National Stock Exchange of India Limited (NSE) has launched trading in US stocks, for resident Indians only, from 3-Mar-2022 via the NSE IFSC. Now eight stocks are available for trading (Alphabet/Google, Amazon, Meta/Facebook, Netflix, Apple, Walmart, Tesla and Microsoft). This will be extended to 50 stocks later.

This news comes at an opportune time given that SEBI no longer permits lump sums and new SIPs in international MFs since 2-Feb-2022.

With NSE IFSC, investors can trade in big-name US stocks without the hassle of opening another broker account and remitting forex.

NSE IFSC Limited (NSE International Exchange) incorporated on November 29, 2016 by the Registrar of Companies, Gujarat, is a fully owned subsidiary company of National Stock Exchange of India Limited (NSE) and has received approval from Securities and Exchange Board of India (SEBI) to establish an international exchange in Gujarat International Finance Tech City (GIFT) - International Financial Service Centre (IFSC) Gandhinagar

You can read more about the NSE IFSC here.

In the previous cases you had to open another brokerage account with some specific Fintech and traditional brokers in India and abroad. NSE IFSC allows you to trade in US stocks from your current broker account, full list here, just like Indian stocks.

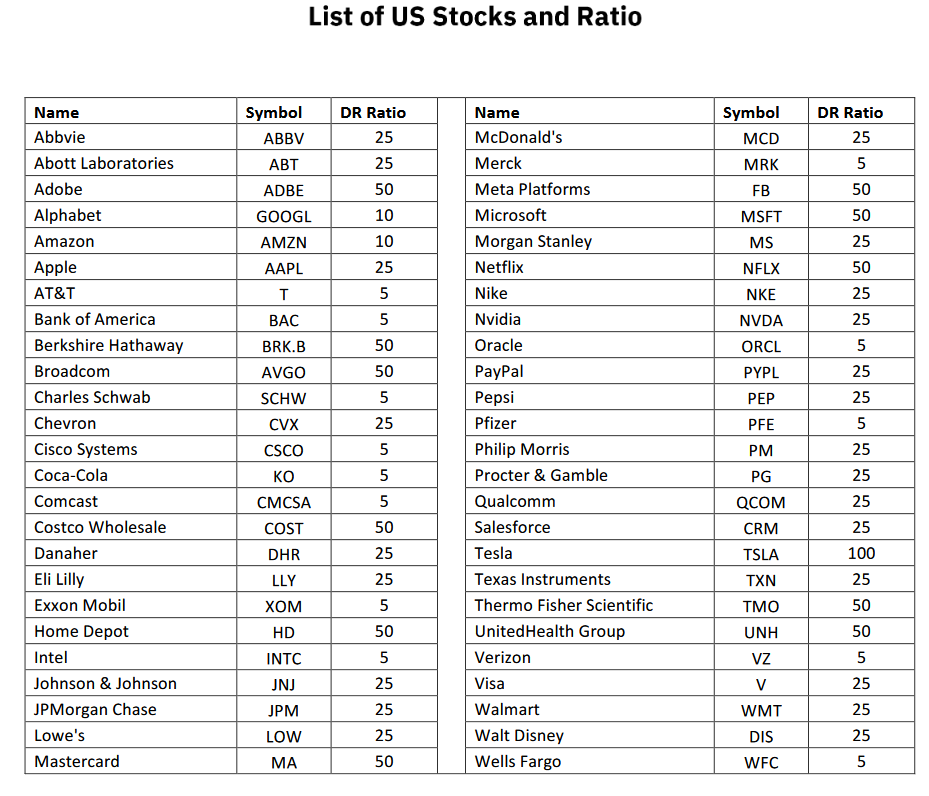

You can buy the stocks without the hassles of forex transfer, fees and related complexities. Fractional ownership of a single share is possible, up to specified ratios, which allow you to own US stocks without a large capital outlay.

Intraday trading is also possible, and the settlement cycle is the standard T+3.

There are two things that you need to keep in mind that will cover in a later part of the article:

As mentioned before, you are buying a Depository Receipt (DR) called NSE IFSC Receipts or USAIDR. A DR is a piece of paper in electronic form that allows residents of one country to buy stocks of another country in their domestic exchange. A custodian bank takes a pool of shares, of say an Indian company, and issues DRs against them. These DRs then trade in USD on the US stock exchange as American Depository Receipts (ADRs).

We already have DRs of Infosys, Wipro and Tata Motors, among others, trading in the NYSE as ADRs while companies like Axis Bank, Reliance Industries, L&T etc. trade on the LSE as Global Depository Receipts (GDRs).

In this USAIDR case, HDFC Bank Limited’s IFSC Banking Unit (HDFC IBU) is the DR issuer and the custodian of the actual US shares is Deutsche Bank AG, New York. The underlying shares are from the S&P500 and will be NYSE/NASDAQ listed for 12 months before consideration.

This structure essentially means that the Indian investor, when they buy a USAIDR, buys a piece of paper issued by HDFC IBU that represents a part of a share of a US company. That share is kept with Deutsche Bank. HDFC IBU will create and issue USAIDRs as per trading volume, with CDSL Ventures the Registrar for these USAIDRs.

For example, the ratio for Apple Stock (Ticker:AAPL) is 25, which means that:

Investors have the option of directly approaching HDFC IBU to get issued USAIDRs in lots, where 1 lot = 1 share of the underlying stock, instead of trading in individual DRs.

Buys can be:

For example, an investor wishing to buy 20 AAPL DRs (ratio = 25) can buy 20 DRs from the exchange via a broker. However, if the plan is to buy 50 DRs, they can also approach HDFC IBU to get 50 DRs created and allotted.

Sells can be:

USAIDRs are traded and settled in USD, which means that price quotations on the NSE IFSC website are in USD. The market hours, with daylight savings time adjustment, will be:

There are some FAQs on the DR structure here. Investors should also go through the Contract Specifications in detail.

Of all the corporate actions in scope, the case of cash dividends is of particular interest. If the underlying company declares a dividend, then you get:

Under Double Taxation Avoidance Agreement (DTAA) which India has with the US, the withholding tax can be adjusted against capital gains.

📕 What is Double Taxation Avoidance Agreement (DTAA)?

For example, if you hold 10000 DRs of AAPL (ratio = 25) that declares $0.22 dividend in the next quarter, the calculation is:

Investors should carefully consider if they are in a position to claim the withholding tax while filing. Else the returns from the stock are severely reduced.

The full list of 50 stocks is available here.

An excerpt from page 33 of the Product Disclosure Statement, emphasis ours, is shown below:

This excerpt says in clear language that:

The feature page of NSE IFSC mentions: “Liquidity by Global HFT” which means that the underlying stocks will be liquid since the order flow will passed on to HFT firms, as per standard practice, for execution. However, this does not imply that the USAIDRs will be liquid. Most ETFs, bonds, SGBs, and long-dated options are thinly traded as per their demand in India. USAIDRs can become an unfortunate addition to this list.

Capital gains from selling DRs will be:

We have already covered the withholding tax. Apart from that, we have to consider estate taxes and compliance.

If an investor owning US assets like stocks, mutual funds and ETFs dies then the US IRS requires payment of up to 40% of the asset market value in taxes, as long as the asset value, at the time of death, exceeds $60,000. Imagine you are a resident Indian investor who has some investments of market value $100,000 (₹75 lakhs) in US stocks and ETFs that you made under LRS. This $100,000 is the market value and not what you invested. If you die today, your nominee or heirs will get $100,000 less the estate tax which could go to as high as 40%. For no fault of yours, except that you died and had more than $60,000 in US assets, the IRS will take a large chunk of your portfolio.

The NSE IFSC US stock trading facility is an important innovation to facilitate Indian investors in owning US stocks. As we have covered before, there are significant benefits for international diversification for Indian investors: Should you invest in international stocks?. However, the USAIDR route is not our recommended route in for investing in US stocks for the reasons of liquidity as mentioned above. Since the tax/compliance hassles are same as opening a standard foreign brokerage amount, investors should consider that route since that will not have the liquidity constraint, full universe of US and global stocks, MF and ETFs as well as the fractional ownership benefits of DRs. However, if the compliance hassles seem to be a lot, then sticking to International feeder funds is the best way for investors.

Investors should wait and watch for a few months to see if liquidity picks up before jumping in. Here is a table that compares the various options.

| Factor | International funds | LRS via brokers | NSE IFSC |

|---|---|---|---|

| Choices | Limited | Full US market | Limited US market |

| Costs | TER of MF/ETF | FX charges, brokerage, minimum balances, TER of funds | Indian brokerage |

| Taxation | Same as Indian MF | Complex | Same as LRS |

| SIP amount | Any | Should be high due to FX charges | Not applicable |

Our recommendation will be to choose International mutual funds for investors looking for investment in US stock markets. Nowadays, index funds are available compared to only active funds earlier. Index funds are well suited to the hands-off investing style recommended in this blog.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled NSE IFSC: trade in US stocks from your Indian broker account first appeared on 04 Mar 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.