What returns should we expect from equity investing?

Equity markets do not guarantee any returns, but we can estimate how much return we will get from SIP or lumpsum investing.

Equity markets do not guarantee any returns, but we can estimate how much return we will get from SIP or lumpsum investing.

A common question among investors is that given stock markets are volatile, what would be the minimum duration of investing so that the principal is not lost. A variation of this question is what kind of return is expected if an investor invests in SIP or lumpsum form for a certain number of years.

We can use historical data to calculate the probability of getting certain returns. However, we should keep in mind that the actual return might differ from the predicted numbers as per the definition of probability.

With this in mind, we will analyse returns in the Indian stock market using the Nifty 50 index and active mutual funds for a single lumpsum investment. We can visualise the volatility of equity markets investing with a graph like this:

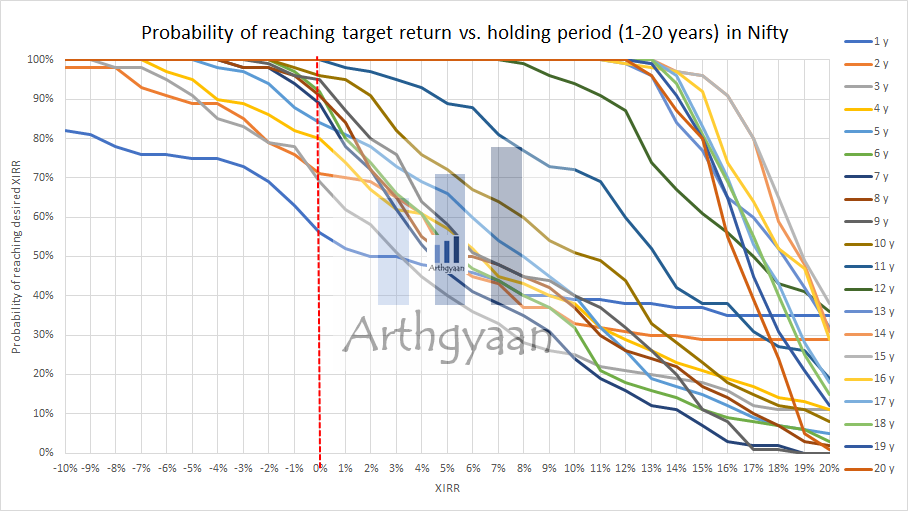

We will use Nifty 50 price index data from 1993 to calculate this probability across multiple holding periods. We see that only beyond ten years or more, the likelihood of losing money drops to mostly zero.

If we repeat this analysis with some chosen active funds with data from 2006, we see the same result.

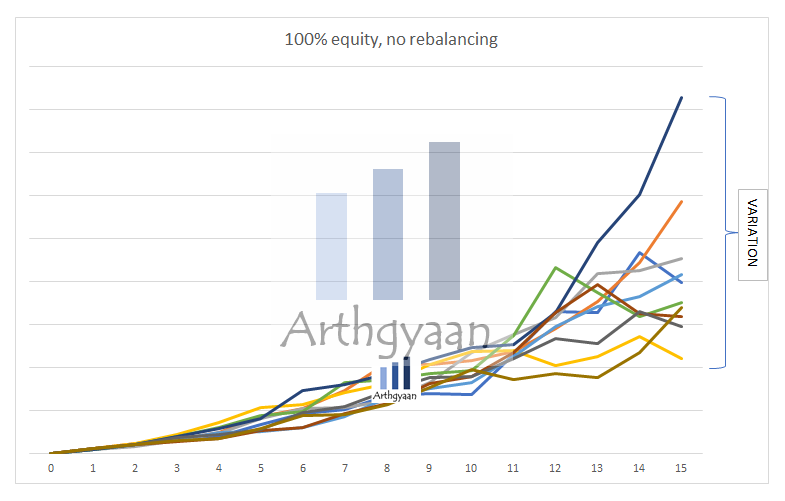

We use actual Nifty 50 price index returns to show the result of running a 25-year SIP. The result shows a significant variation in the final portfolio amount depending on when the SIP was started and the intermediate yearly returns.

We will now calculate the probability of getting a particular return, say 12%, across multiple holding periods. By this, we try to see that across various holding periods, from one week to 15 years, the probability that the XIRR is at least 12%.

We see two trends demonstrating the volatility of the market:

Investors need to be mindful that investing in lumpsum over short periods has a considerable probability of loss.

Let’s take the same data and run a SIP instead for various periods from one year to 20 years. We see that there is no guarantee that just by running a SIP, you can reach a desired target return simply by investing longer and longer. For example, to get an XIRR of 12% via SIP, the probability is less than 40%. We have achieved this conclusion before as well when discussing the returns we get for our SIP calculator: I have started a 15k SIP. How much money will I have in 15 years?

When using any result based on probability, we need to be very clear of our expectations. The counter-question regarding keeping money safe while investing in equities is that is it the correct expectation?

Equity investors, specifically those who have been investing for some time, understand that the equity markets go up and down. This experience would lead them to adopt risk management methods like rebalancing or goal-based investing since investors should prefer not to leave things to chance.

The way forward for investors will be to invest as per their goals as described in this post: I have just started earning and do not know a lot about finance. What now?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What returns should we expect from equity investing? first appeared on 22 Nov 2021 at https://arthgyaan.com