How much of your income should you invest every month?

The answer is mostly “it depends” but you can easily figure out the number from this post

The answer is mostly “it depends” but you can easily figure out the number from this post

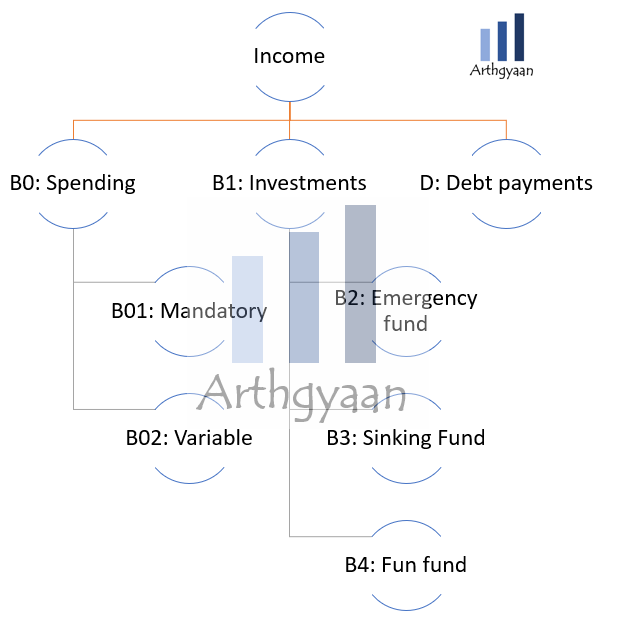

A monthly household budget has four parts

This post deals with the allocation of the first line item in the budget. We will not advocate a thumb rule-based approach since that is not applicable uniformly based on income, expenses and investments needed. Instead, we will use the plan for all goals together to figure this out.

We will use information that is already there with us regarding goals like major purchases (car, house down-payment), children’s education and retirement and plug them into the sheet and use the default assumptions. Along with this, we will use the value of any investments already made that will be used in the corpus field.

This will throw up a SIP figure for all goals based on the assumptions made. If this is lower than what you are already able to invest today then you are mostly good. If you can firm up the assumptions a bit (see below), then it is great. Everyone with a higher SIP figure than they can invest today will need to revisit their goals.

Goals have three main parameters that lower the amount needed to be saved today:

Inflation: the impact on your goals and how to choose assets that beat it

You can also consider if you can drop goals that may be revisited later like funding a sibling’s education or children’s marriage. Goals like children’s education may be funded via loans and scholarships while targets like retiring early may be lowered. This topic is discussed in more detail in this post.

It will be a good idea to do a formal goal-planning exercise with your family to map out the goals.

If you have multiple loans, then use the Avalanche method to pay off the highest balance loans first like credit card and personal loans. This frees up money the fastest and allows you to invest more. If you have a housing loan then you might reconsider pre-paying them since you could get higher returns for long term goals by investing.

Once the new assumptions are made, input them into the calculator to get the new SIP amount. It may still come higher than what you can realistically save as of this moment. Please use this as a wake-up call for your finances since it is both dangerous to invest too less when you can invest more as well as delaying too long due to inaction. Do not go with a belief that “saving x%” is enough for goals since that will not apply to your situation. Given tools like this you can easily run the numbers yourself to find out how much you need to invest.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much of your income should you invest every month? first appeared on 04 Jul 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.