How to prioritize goals based on available monthly SIP amount?

What to do when goals do not proceed on track and not enough surplus is available for investing.

What to do when goals do not proceed on track and not enough surplus is available for investing.

When an investment plan is prepared, there are many assumptions that are made regarding future equity and debt returns, salary growth and inflation that may not hold once investments have been running for a few years. Market returns may be different from what was initially available (higher or lower), salary growth may be lower or goals may themselves change. Due to this, a yearly review and rebalance is recommended. This post deals with what to do if the new SIP amount post the review is lower than expected. We will use the plan for all goals together to figure this out.

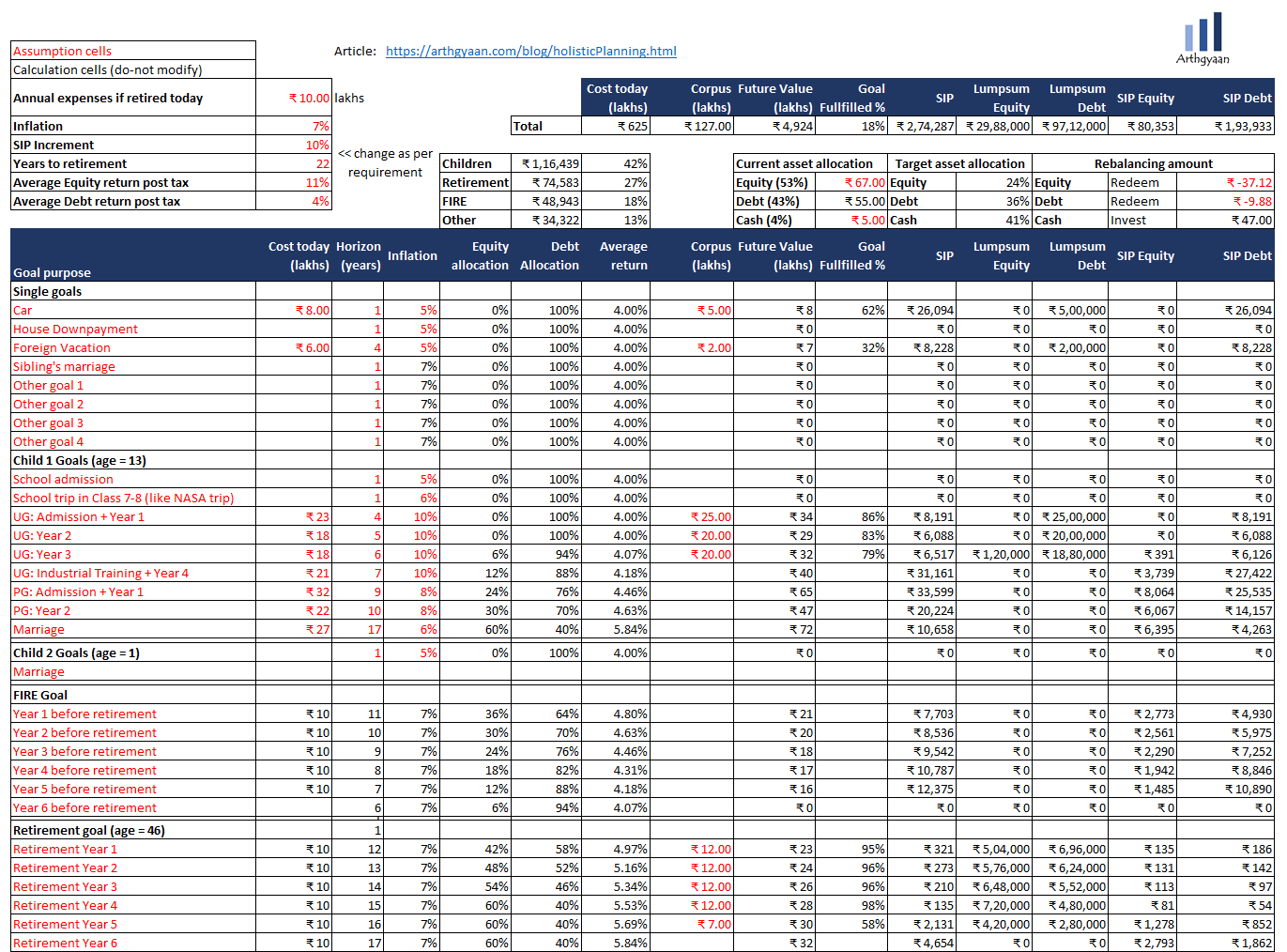

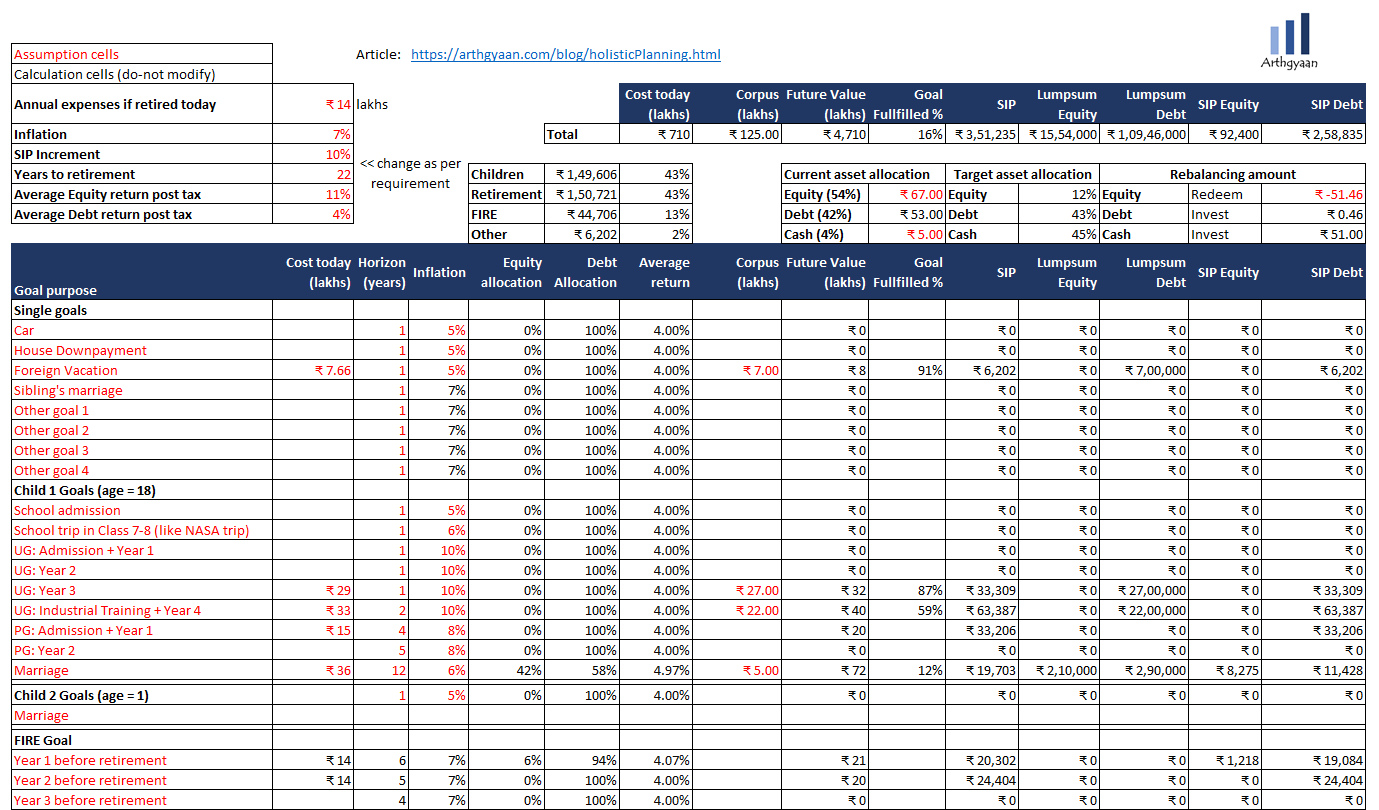

As this shows, there is a SIP of ₹ 1,00,250 that has been started by a family for goals like a car, house down-payment, vacation, children’s education, retirement at 58 and early retirement (if possible) 5 years before 58 who currently have a corpus of ₹ 50 lakhs. Currently, the family is investing the most for children’s education, followed by retirement and FIRE. We will see what happens 10 years later. This is a typical scenario since the children’s education goals are due sooner than retirement and for many families, education goals are at a higher priority than the rest.

We see that the portfolio of ₹ 50 lakhs has grown to ₹ 127 lakhs, the house has been purchased, the child is 13 years old and the previous single goals (car, vacation, school-related goals) have been reached with new car and vacation goals added. The biggest change here is the doubling in annual expenses in retirement from ₹ 5 lakhs/year to ₹ 10 lakhs/year due to inflation. Also as expected, all the other goals like children’s education and marriage have grown due to inflation as well. The new SIP amount is now ₹ 2.74 lakhs. The challenge here is that the family, due to other commitments (maybe a one spouse becoming stay-at-home or the impact of the home loan EMI) can only invest ₹ 1.7 lakhs/month.

Goals have three main parameters that lower the amount needed to be saved today:

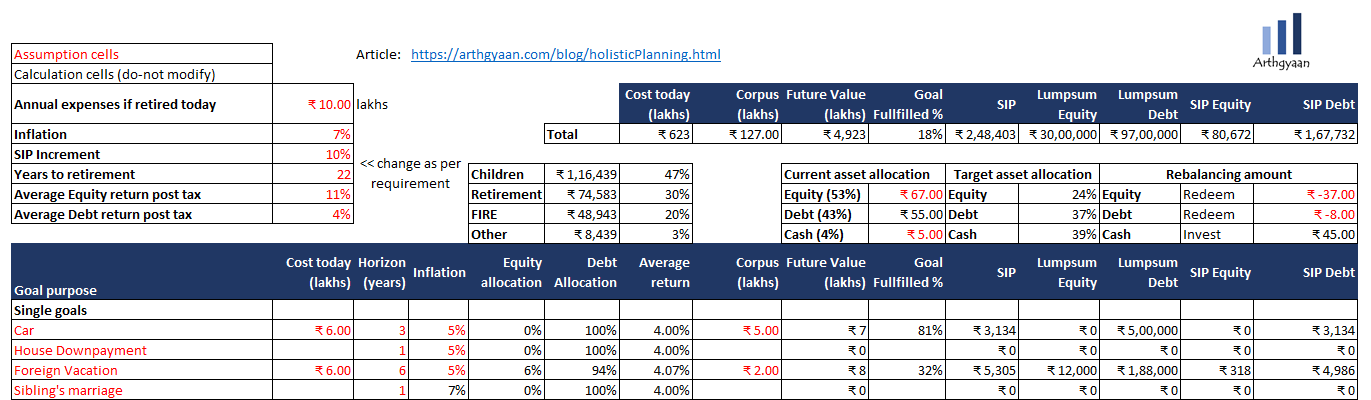

Here the car and vacation goals are pushed out for some time which reduces the SIP to ₹ 2.48 lakhs.

Do you want to save more for retirement vs. college education of children for which loan can be taken?

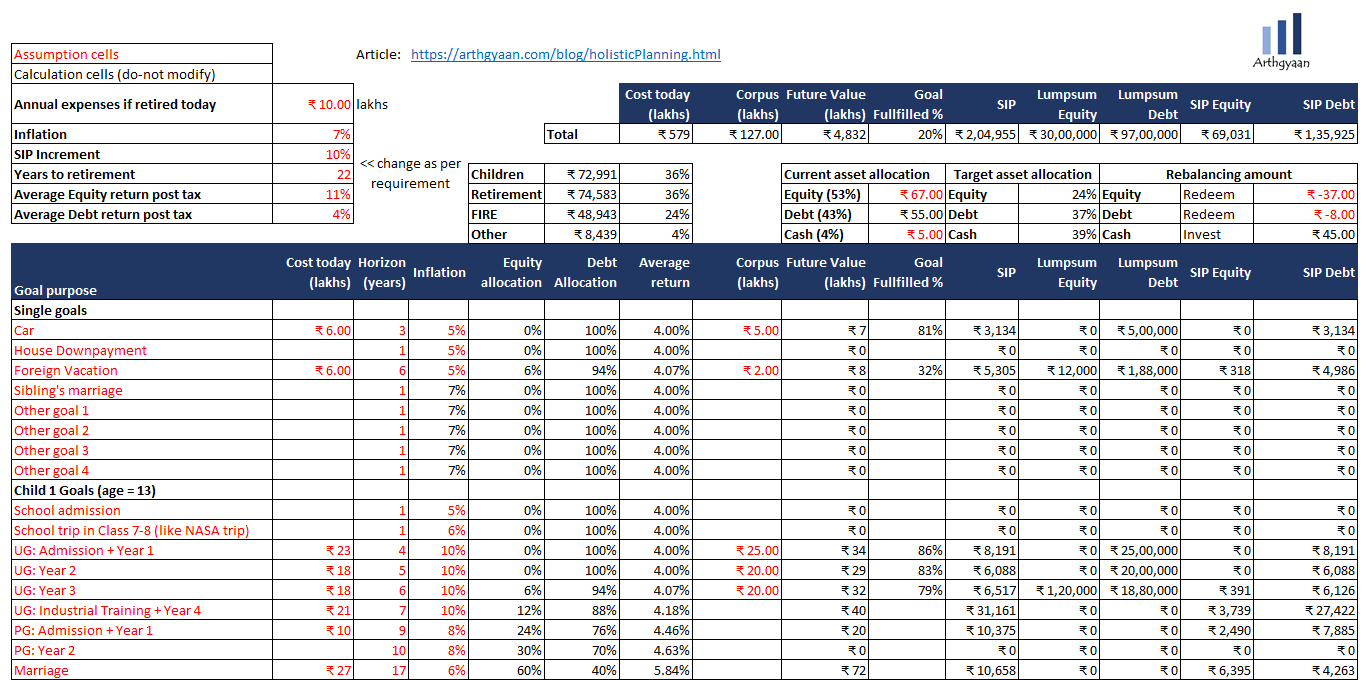

Here we reduce the PG education target (leaving a token starting amount) considering that they can be funded by loans and scholarships. This reduces the SIP amount to ₹ 2.05 lakhs.

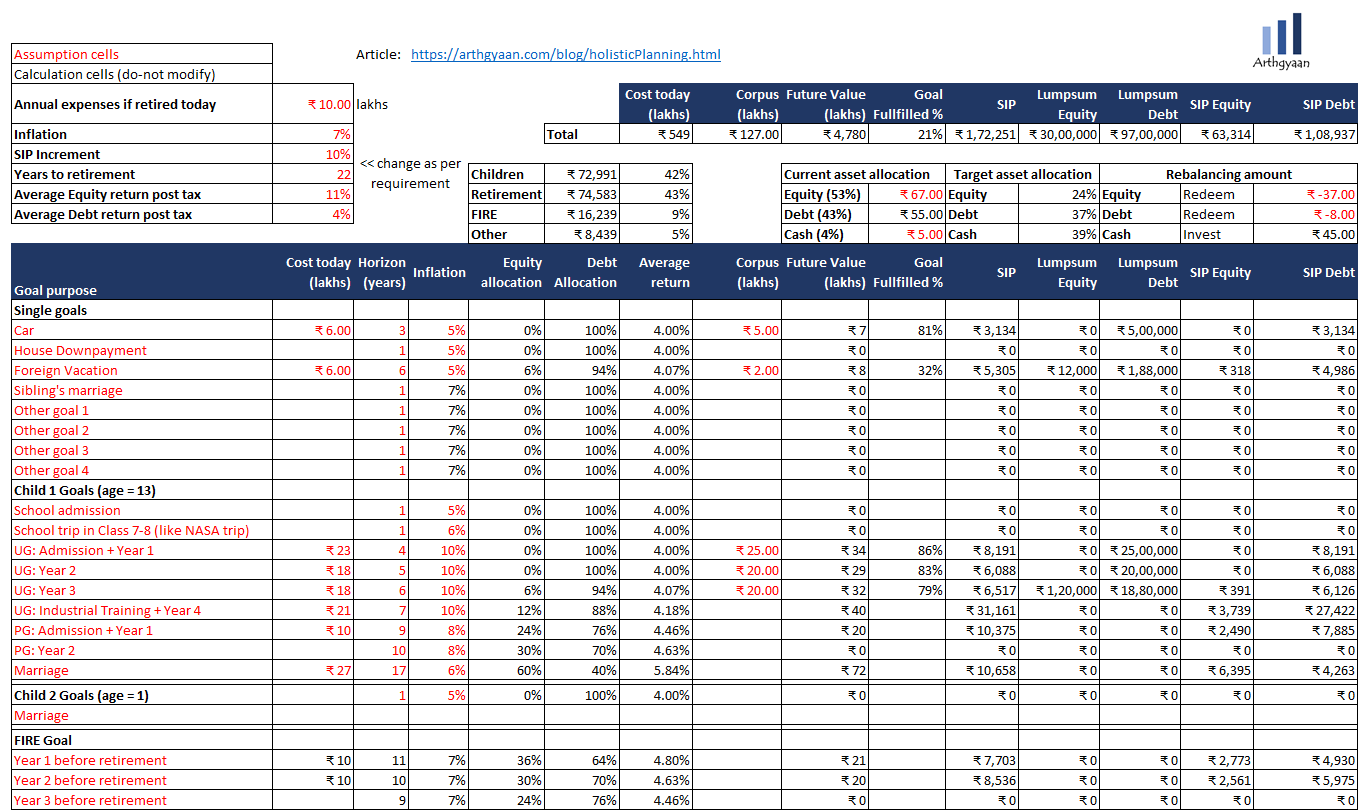

For example, instead of early retirement, do you want to consider a more traditional retirement age or a lower time spent in early retirement? Here three years of early retirement is dropped (early retirement is now targeted at age 56 instead of 53). This drops the SIP requirement to ₹ 1.72 lakhs which is in line with what the family can now invest.

We will now consider the reverse situation 5 more years down the line.

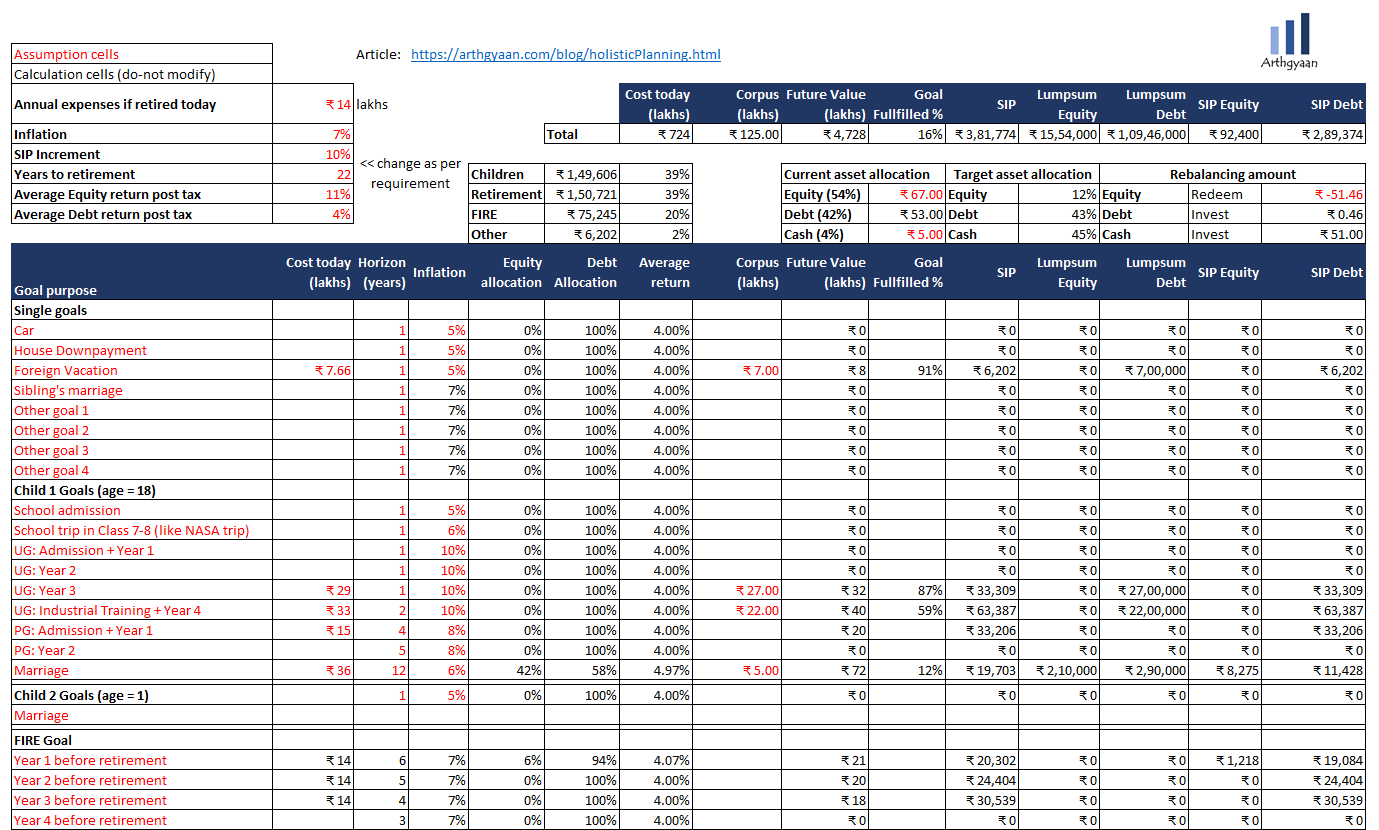

We see that the portfolio of ₹ 1.27 crores is now ₹ 1.25 crores, the next car has been purchased, the child is now in 2nd year which means admission fees and tuition/hostel and related expenses for 2 years have been paid. The annual expenses in retirement have increased from ₹ 10 lakhs/year to ₹ 14 lakhs/year due to inflation. There is now a ₹ 5 lakhs allocation to the marriage goal which was earlier not possible. The family now has ₹ 3.8 lakhs of SIP amount they can invest every month which is ₹ 29,000 higher than the ₹ 3.51 lakhs shown in the plan.

We add back one more year in early retirement that takes the early retirement target to 55 (instead of 56 after 10 years) and this takes the SIP amount to ₹ 3.8 lakhs.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to prioritize goals based on available monthly SIP amount? first appeared on 05 Jul 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.