How to buy luxury property in India from salary income?

This article helps you figure out how to purchase real estate priced over ₹1.5 crore.

This article helps you figure out how to purchase real estate priced over ₹1.5 crore.

This article is a part of our detailed article series on the concept of buying luxury properties. Ensure you have read the other parts here:

This article shows the minimum income needed to buy a luxury property in India.

This article gives you some points to think about if you are buying a second house which is a luxury property.

Luxury Homes Priced Rs 4 Cr & Above Saw More than 75% MORE Sales Last Year In Top 7 Cities: CBRE

This and others similar to it were in the headlines on 14th Feb, 2024 in many newspapers. The question that arises is: What makes a house (villa or apartment) a luxury property? A luxury property:

The price tag of ₹1.5 crore is a general guideline, as you will seen in news articles, since if you go to say Mumbai, you cannot buy much at that price.

We need to check for these things for the builder who is offering the property:

Such properties will be predictably more expensive than those without all these checks being true.

You can buy a house via a mix of your own funds and a home loan. We have covered this topic in more detail here:

If the house has a loan component, then the maximum value of the house is capped by the amount of loan the bank will sanction. In this article, we will consider a house that costs ₹1.6 crore, for easy calculation, and look at various ways of buying it.

We will now cover the case where you currently stay on rent or with your parents. You are now planning to buy your first house as a luxury purchase. We will consider two cases:

You have to pay the entire amount at one go for a ready-to-move house. A bank will give you no more than 75-80% as a home loan. This calculation means you need to pay at least 20-25% to the seller from your pocket. So, you need to arrange for 25% of ₹1.6 crore, which is ₹40 lakhs today.

There are many ways of getting to this ₹40 lakhs:

For the remaining ₹1.2 crore, you have to take a home loan. If you take a 15-year loan at 9% interest, you will pay ₹1.2 lakhs/month as EMI (as per this article)

There will be tax benefits as well on both principal and interest that we recap here:

Home loan tax benefits are of two types depending on the construction status of the house.

If the house is ready to move, then

If the house is under-construction, then

None of these deductions are applicable in the new tax regime. Section 24B is available in new tax regime only if the property is let out and not self occupied.

As a home owners should always check first if you will save more tax in the new tax regime in this case: Which is the best tax regime to choose from April?

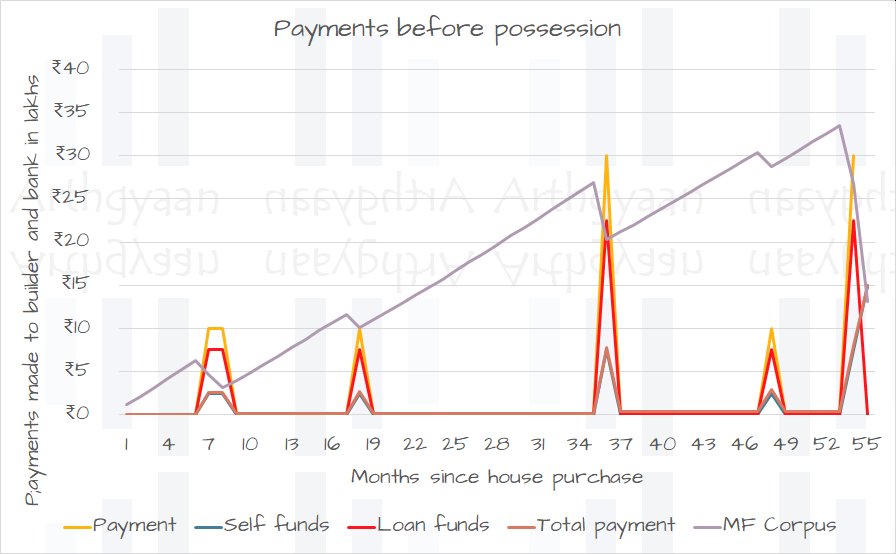

An under-construction house allows you to space out the payments over multiple years. This is a good thing since

To understand how to plan such a house purchase:

The last case is interesting. If you have 10 lakhs of cash with you for paying the booking amount, then a ₹1.6 crore luxury under-construction apartment can be yours if you can spend ₹1.6 lakhs a month like this:

We have covered this case in detail here: How to Buy Your Dream Home Without Any Savings: A Step-by-Step Guide

Of course, here also you are paying ₹40 lakhs out of your pocket and the rest ₹1.2 crores comes from home loan. It is just that you can manage to pay the down-payment over time as well as get the benefit of lower EMI in the moratorium period.

If you change your mind at any point regarding this purchase, you can always calculate your returns and exit if needed: How to correctly calculate returns from an under construction flat?

Buying a luxury property requires two things that you must take care of going forward:

Here you need to plan very carefully regarding the home loan you are taking:

You should always take the highest possible loan in terms of duration to get the maximum flexibility in payment terms and least upfront interest cost. You always have the option of prepaying as per your convenience as salaries increase. Nowadays most banks offer home loans without prepayment charges.

Apart from EMI of the home loan, your monthly expenses will have to include maintenance costs which is always on the high side (rate per square foot) for luxury properties. Paying maintenance supports the infrastructure of the luxury property (like clubhouse, security, building maintenance) and supports the price of the property.

Maintenance rates of ₹4/sq ft or higher is typical and should be added to the monthly budget.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to buy luxury property in India from salary income? first appeared on 21 Feb 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.