A tactical trading opportunity in gold vs. equity

A case study on tactical asset allocation: a divergence in the prices of gold and equty offers a trade. What can you do and when?

A case study on tactical asset allocation: a divergence in the prices of gold and equty offers a trade. What can you do and when?

Disclaimer: This article is intended as an educational case study on tactical asset allocation. This article is not investment advice.

Strategic asset allocation (SAA), which has been discussed in this article in detail, defines that for each goal you need to have a fixed mix of various assets like equity and debt say in a 60:40 ratio. Over time, as the goal comes closer, you should reduce the allocation to risky assets and increase the allocation to safer assets to ensure that the goal is met. This concept is called rebalancing via a glide-path.

Tactical asset allocation (TAA henceforth) temporarily changes the portfolio’s asset allocation to act on an opportunity as per market conditions. For example, in an equity bull market, re-balancing from equity to debt as per trigger condition may be delayed to let the equity portion of the goal increase a bit more. In addition, TAA may change the portfolio’s risk profile if the decision goes wrong and require a more frequent review and re-balancing.

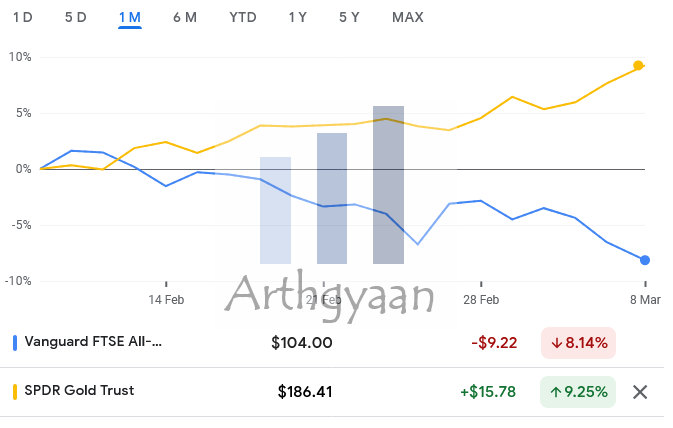

This article deals with a similar case due to the recent run up in gold prices vs. equity. In the image above we are seeing the price movement in one month ending 8-Mar-2022, of the Vanguard FTSE All-World UCITS ETF as a proxy for global stocks vs. the SPDR Gold Shares (GLD) which represents gold. We can see that in this period, gold prices and stocks have diverged by over 17%. This divergence presents an opportunity to tactically reduce the allocation to gold in a portfolio to buy more stocks and let the situation reverse. This will be a short term trade, say between 1 to 3 months, after which we expect to reverse the positions: sell equity and buy gold to restore the desired strategic asset allocation.

The trade is capital-neutral but not market neutral.

The profit potential depends on:

The main risk here is that gold and equity keep moving in their current direction longer than expected.

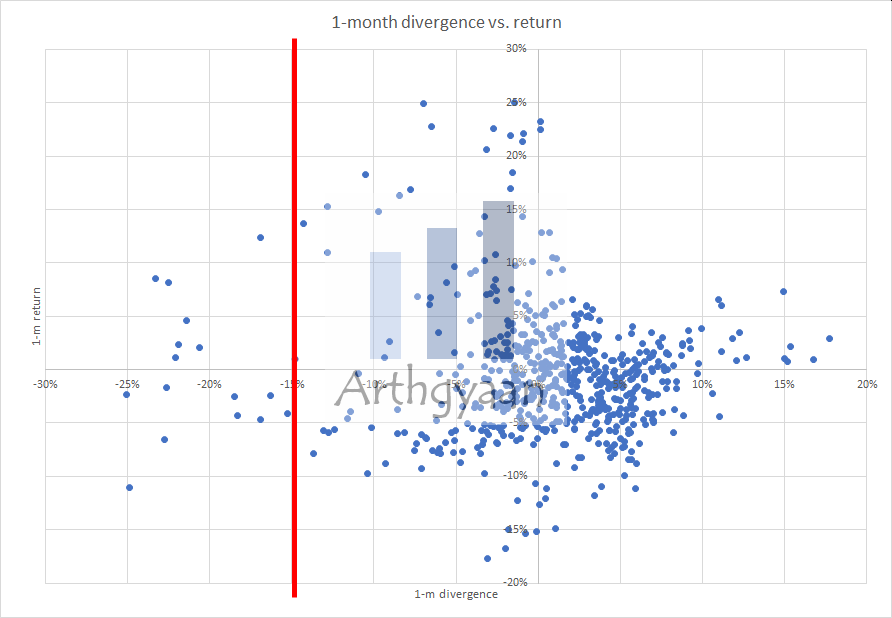

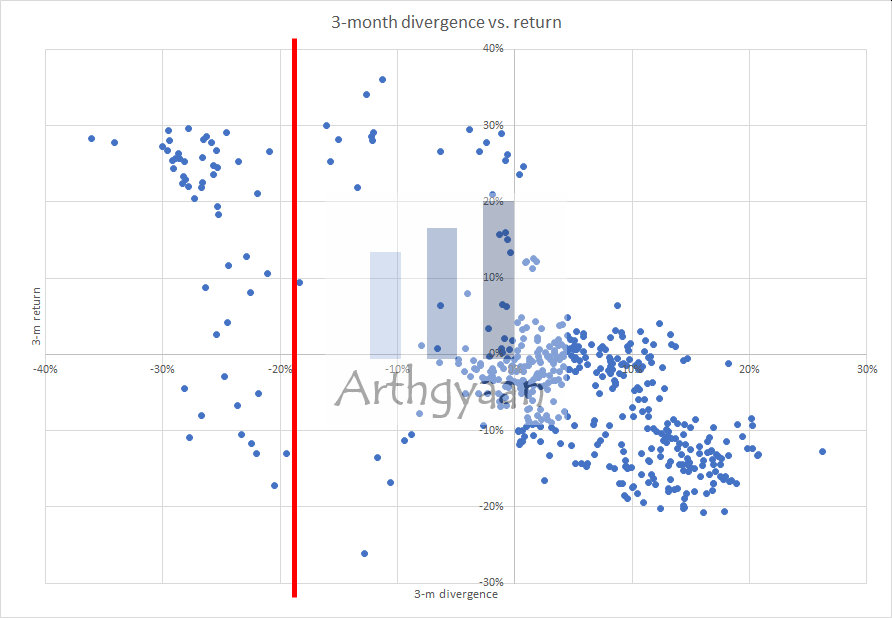

We show two charts: the one-month and three-month deviation of equity vs. gold prices and the corresponding return of this trade after the same period. Currently, the 1-month return of equity over gold is -14%, and the 3-m return is -17%. This divergence is marked with the red line in the graphs.

As per historical data, we see that the three-month divergence is a stronger indicator of a positive return than the 1-month divergence.

We have earlier advocated for an asset allocation to gold of no more than 60% of the total equity allocation in a portfolio. Realistically, 5-10% of the total asset allocation for long-term goals can be in gold. This trade will only work if your gold holding is liquid, like a gold ETF or MF. You cannot sell SGB unless you have held them for more than five years after issuance and can sell them in the secondary market.

There are two cases:

Your gold allocation is higher than the strategic allocation for your whole portfolio due to the recent increase in gold rates. You can trigger that excess into equity. You can switch to an equity fund of the same AMC.

This means that your current allocation to gold is lower than what you wish to have. You can still trade but will probably want to exit quickly.

There are two legs:

It is difficult to predict when is the right time to enter the trade as we cannot be sure if either gold has peaked or equity has bottomed. The same consideration will apply at the exit leg as well. Say that you have decided to allocate 5 lakhs of gold holding to this trade at current rates.

You can use a rule based approach:

A rule-based approach will remove the role of emotions and regret if the trade does not go as planned.

Capital gains tax on gold is at slab rates if held for less than three years. Only if kept for longer, the tax becomes 20% with indexation. Tax considerations in the entry leg where gold is sold should be considered before executing the trade. Since indexation applies as every financial year concludes, the tax due to indexation will be lower if the entry leg happens on or after 1-Apr-2022 with everything else remaining the same.

For equity, tax is lower since before one-year holding, the tax is 15% of profits, and after one year, it is 10% of the profit above 1 lakh.

We have covered capital gains taxes in more detail here:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled A tactical trading opportunity in gold vs. equity first appeared on 09 Mar 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.