Which are the safest types of equity mutual funds?

This article helps you understand which categories of equity funds are the safest for investors.

This article helps you understand which categories of equity funds are the safest for investors.

Equity mutual funds, by their very nature, are “unsafe”. Their returns fluctuate with time and lead to unpredictable values for a corpus, as we have discussed in detail here: The lie of wealth-creation via SIP in mutual funds

However, many investors will benefit from an inter-ranking of equity mutual funds as per their inherent risk, and this article addresses that point.

Caveat: The data in this article is a point-to-point result produced on the article’s publishing date, using mutual fund data for the previous three years. The ranking and the absolute values of risk will change with time.

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the values are spread out over a wider range. - Wikipedia

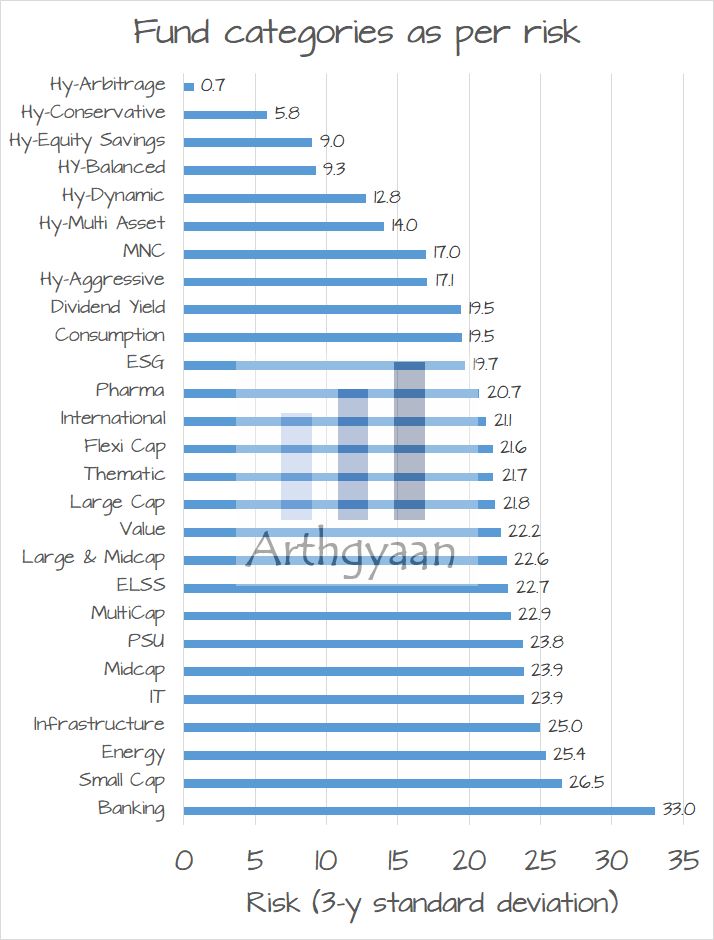

Generally, the higher the standard deviation (SD), the higher the risk of a mutual fund. If a fund has a standard deviation of 15%, its yearly returns are expected to be between -60% to +45%. In general, we can say:

Yearly return range = [-4 * SD, 3 * SD]

We use annualised standard deviation and the last 3-year return data for mutual funds as provided by the Valueresearchonline website.

We have used the SEBI categorisation of funds in defining the categories below. Since hybrid mutual funds also have some equity allocation, we have included them in our list.

We have arranged the fund categories in ascending order of risk. Due to having less than 100% equity allocation in all cases, we see that the hybrid funds are the safest in terms of risk.

A few other observations:

Investors should note that looking at only risk is one part of the analysis they need to make to shortlist mutual funds. The next level of study they need to perform is how much return these funds have given, grouped as per risk. We will cover this aspect in a future article.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which are the safest types of equity mutual funds? first appeared on 22 Mar 2023 at https://arthgyaan.com