Review: LIC Digi Credit Plan (UIN: 512N358V01) as loan insurance for your dream home

This article discusses the new LIC Digi Credit Plan (UIN: 512N358V01) policy and how it can be used as loan insurance for your home loan.

This article discusses the new LIC Digi Credit Plan (UIN: 512N358V01) policy and how it can be used as loan insurance for your home loan.

LIC Digi Credit Plan (UIN: 512N358V01) is a term insurance plan launched by the Life Insurance Corporation (LIC) of India on 5th August, 2024.

This product is a pure risk term insurance product with a reducing cover meant to act as loan insurance cover for loans like home or vehicle loans.

This policy will pay out the remaining part of the loan in case you die, ensuring your family home (in case of loan insurance for a home loan) will not be repossessed by the bank due to non-payment of EMIs. As the loan balance reduces over time with EMI payments, the cover of this policy will also reduce over time.

| Criteria | Details |

|---|---|

| Minimum Age at Entry | 18 years (Last Birthday) |

| Maximum Age at Entry | 45 years (Last Birthday) |

| Minimum Age at Maturity | 23 years (Last Birthday) |

| Maximum Age at Maturity | 75 years (Last Birthday) |

| Minimum Basic Sum Assured | ₹ 50 lakhs |

| Maximum Basic Sum Assured | ₹ 5 crores |

| Purchase Mode | Online Only from LIC website |

The reducing cover policy like LIC Digi Credit Plan will be cheaper (in terms of premium) compared to a level-cover term policy whose coverage amount stays constant over the coverage period.

An offline version of this plan, sold by LIC agents, is available as LIC Yuva Credit Life (UIN: 512N357V01).

To explain the concept of loan insurance, we will take the example of a home loan. A home loan carries several risks starting from the moment you borrow money:

To mitigate some of these risks, there are insurance policies:

A policy like LIC Digi Credit Plan can act as the loan insurance product.

To understand if you need loan insurance or not:

We have covered this topic of loan insurance in detail here: Understanding Insurance Requirements for Home Loans in India: What’s Mandatory and What’s Optional?

Just because a reducing benefit term-insurance product targeting loan insurance customers exists, does it mean that you should go ahead and buy it? Instead, if you are taking a home loan, it more importantly means that this is a good time to review your entire term insurance cover requirement. We have discussed earlier, like via your annual portfolio review, you need to check if your existing term insurance cover is suitable for your assets (your shares, mutual funds, PF, etc.), goals (retirement, children’s education, etc.) and loans (like this home loan).

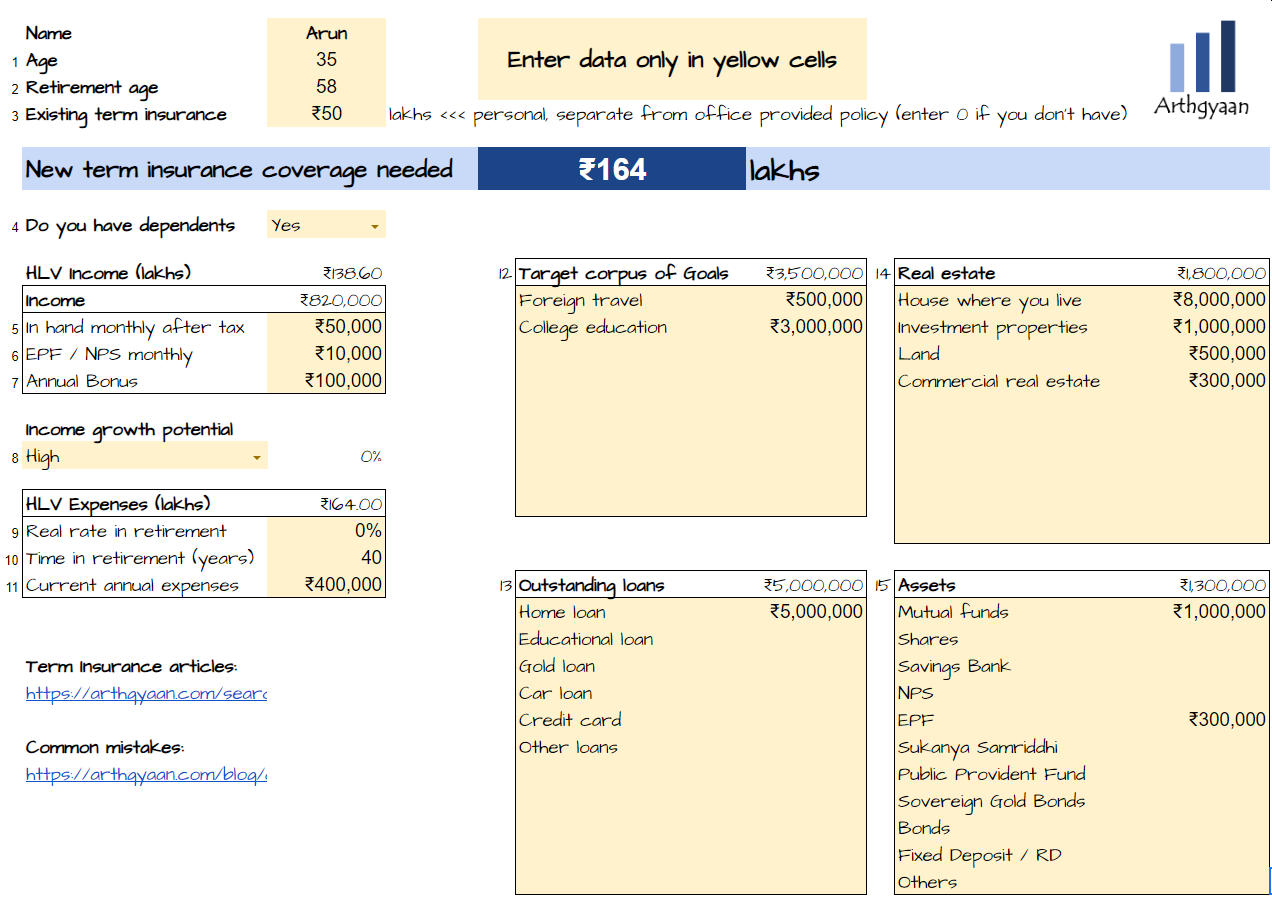

We have a term-insurance calculator here that will help you do this calculation: How to calculate term insurance coverage amount?. If you feel, after using this calculator, that a reducing cover term-plan is suitable, then you can consider such plans. Otherwise, you should skip a policy like this.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Review: LIC Digi Credit Plan (UIN: 512N358V01) as loan insurance for your dream home first appeared on 05 Aug 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.