How to balance FOMO and loss-aversion in the case of foreign RSUs?

This article gives you a few pointers about what to do with your foreign RSUs that have appreciated a lot in value.

This article gives you a few pointers about what to do with your foreign RSUs that have appreciated a lot in value.

Disclaimer: Fund names in the article are not recommendations to invest in those funds.

This article answers a question from our Facebook group.

Please feel free to join the private Facebook group to ask your own questions here:

See the actual post on Facebook.

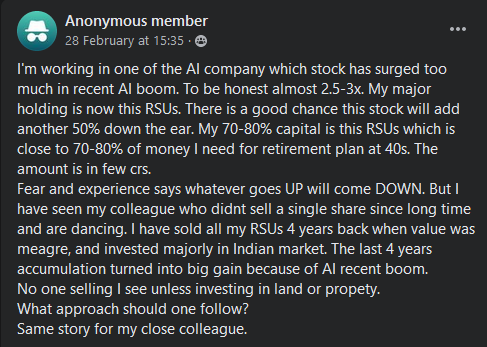

I’m working in one of the AI company which stock has surged too much in recent AI boom. To be honest almost 2.5-3x. My major holding is now this RSUs. There is a good chance this stock will add another 50% down the ear. My 70-80% capital is this RSUs which is close to 70-80% of money I need for retirement plan at 40s. The amount is in few crs.

Fear and experience says whatever goes UP will come DOWN. But I have seen my colleague who didn’t sell a single share since long time and are dancing. I have sold all my RSUs 4 years back when value was meagre, and invested majorly in Indian market. The last 4 years accumulation turned into big gain because of AI recent boom.

No one selling I see unless investing in land or property. What approach should one follow? Same story for my close colleague.

Let us extract the key details from the query:

Before delving into the analysis, there are two caveats:

No one can predict the future. We cannot predict what the stock will do in the short or long term

For most people, Loss aversion is more real than missed gains

There are only four scenarios here:

| Scenarios | You Sell | You Keep |

|---|---|---|

| Stock Goes Up | Case 1 = 😬 | Case 2 = 🤑 |

| Stock Goes Down | Case 3 = 😁 | Case 4 = 😡 |

Our problem here is to manage Cases 1 and 4. We will assume a ₹2 crore position in the stock.

On the ₹2 crore position, you now have:

₹40 lakhs cash (pre-tax) + ₹1.92 crore stocks (after 20% jump)

The share sale, for foreign stocks, will be taxed at

This case is worse compared to case 1.

On the ₹2 crore position, you now have:

₹1.6 crore in stocks (20% fall) and no cash since you did not sell

This case is not as bad as Cases 1 and 4. If you sold only partially and the stock went down, then you have some cash and a lower position. Assuming a 20% fall and a 20% sale before the fall you have, out of the ₹2cr position:

₹40 lakhs cash (pre-tax) + ₹1.28 crore stocks (after 20% fall)

This one is a simple one. You do nothing and the stock goes up 20%.

The ₹2cr position is now worth ₹2.4cr

In summary, with a 20% move in the stock (up or down) with a 20% sale if sold,

| Scenarios | You Sell 20% | You Hold |

|---|---|---|

| Stock Goes Up 20% | ₹28L cash + ₹1.92cr stocks | ₹2.4cr stocks |

| Stock Goes Down 20% | ₹28L cash + ₹1.28cr stocks | ₹1.6cr stocks |

So we can see that the cases where the stock rises, the end result differs only slightly due to lost profits and tax on the sale (around 10% of the position assuming 30% tax = ₹12L of the sale amount)

However, if the stock goes down and you sold before that, you might be worse off due to the tax on the sale.

To understand how to deal with such a stock position:

There are a few things that can be done:

Here x can be 5-10%. After 3 months, the position will be pared by 15-30%.

You can use that cash to:

There will be a substantial tax hit as explained above.

Here you sell x% percentage of holdings now and then do nothing. x = 20-50%.

You can rotate into ETFs (for diversification) or real estate (to reduce tax). You do lose some upside in case the stock goes up but some cushioning will be there based on the performance of what you invested in after selling the stock.

If the stock does go down, and if you were not planning to sell a lot, then depending on how old the vested units are, you might be better off not selling.

You can make a rule:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to balance FOMO and loss-aversion in the case of foreign RSUs? first appeared on 13 Mar 2024 at https://arthgyaan.com