Returning to India? What to do with your NRE and NRO accounts and by when?

This article explains the rules for dealing with NRO, NRE, FCNR and RFC accounts for an NRI returning to India from both FEMA and Income Tax perspective.

This article explains the rules for dealing with NRO, NRE, FCNR and RFC accounts for an NRI returning to India from both FEMA and Income Tax perspective.

What Happens to NRE and NRO Accounts When Returning to India?

Upon returning to India, NRIs must re-designate their NRE and NRO accounts to resident accounts. NRE accounts should be converted to Resident Rupee accounts or transferred to RFC accounts to maintain tax efficiency. NRO accounts, which are already taxable, must also be re-designated. It's crucial to inform your bank promptly to ensure compliance with FEMA regulations and avoid potential tax liabilities.

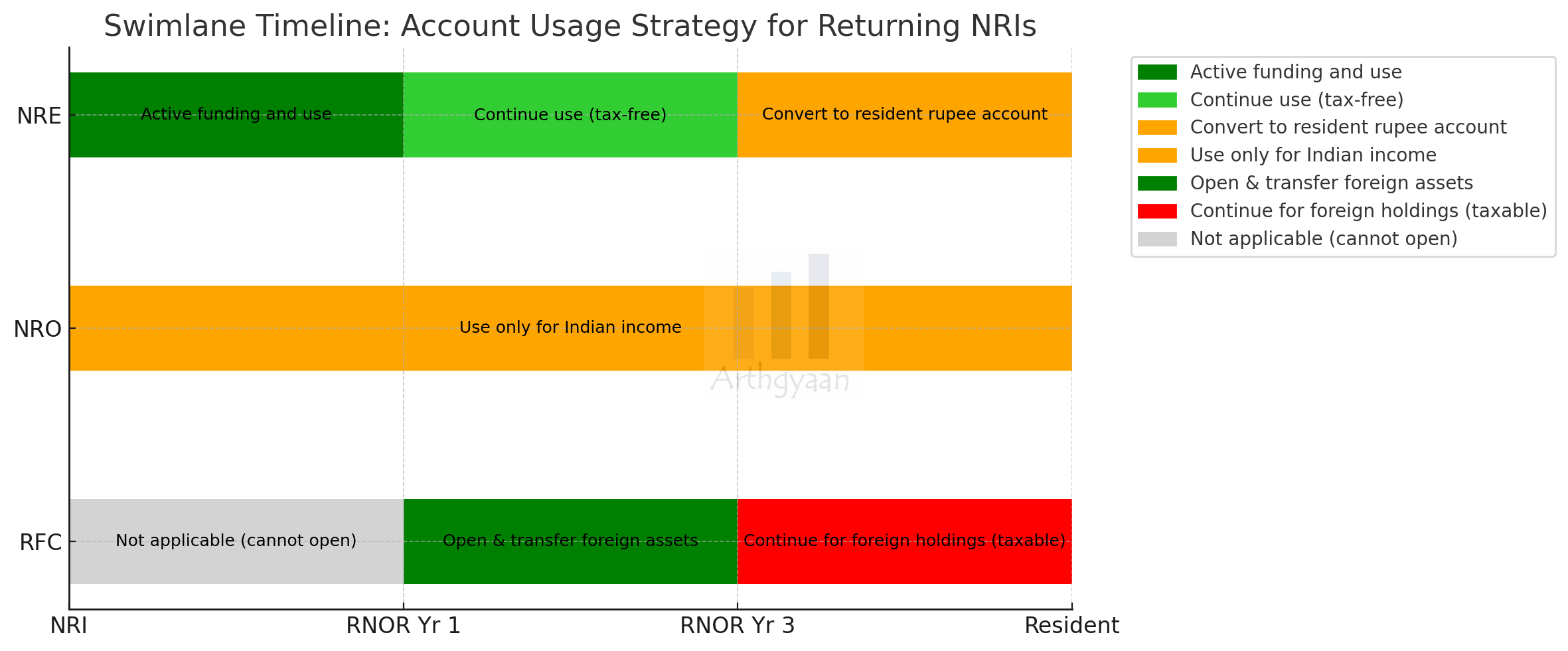

Timeline: Pre-Return ➝ RNOR ➝ Resident

| Step | Time frame | Action |

|---|---|---|

| 1 | Immediately on return | Inform bank of change in residential status; retain NRE/NRO status until reclassified |

| 2 | Month 1 | Open RFC Account; transfer any foreign assets (cash, deposits, pensions, matured policies abroad) into RFC |

| 3 | Ongoing | Keep using NRE for foreign remittances ➝ tax-free interest; do not route foreign funds via NRO in-case you want to go back |

| 4 | During RNOR | Consider prepaying Indian liabilities or investing from RFC to avoid eventual taxation post-RNOR |

| 5 | End of RNOR (~Year 3) | Plan for any large outbound remittances or currency hedging from RFC before losing repatriability or tax-free status |

Notes:

| Step | Time-frame | Action |

|---|---|---|

| 1 | ROR stage | NRE account (if still active) must be converted to Resident Rupee account |

| 2 | ROR stage | RFC continues but interest is now taxable; consider merging or converting depending on currency needs |

| 3 | Ongoing | All interest income (RFC) now taxable |

| 4 | If planning to emigrate again | Do not transfer foreign funds to ₹ accounts; use RFC to preserve currency denomination and repatriability |

If RNOR is not applicable, as per the classification rules (see this RNOR status calculator), the returning NRI directly becomes ROR status holder.

To comply with the Foreign Exchange Management Act (FEMA) rules, an NRI cannot have regular savings accounts in India. Therefore, you must convert existing accounts to NRO accounts and excess accounts must be closed. This step is important once your status changes from resident Indian to NRI and can be done either online, for selected banks, or during your next visit to India.

| Feature | NRO Account | NRE Account | FCNR(B) Account | RFC Account |

|---|---|---|---|---|

| Income Source | Indian income (including capital gains) |

Primarily foreign income, some taxable Indian income |

Foreign currency deposits | Funds held in foreign currency by returned NRIs |

| Repatriation | Allowed with Forms 15CA/15CB, up to $1 million/year |

Fully repatriable (for foreign income and taxable Indian income) |

Fully repatriable | Fully repatriable |

| Limits | Unlimited when deposited; $1 million/year on repatriation |

No limits on deposits/withdrawals | No limits on deposits/withdrawals | Generally no specific limits defined, but related to funds brought back upon return or received from specific sources |

| Capital Gains | Can receive proceeds from sale of assets | Cannot receive proceeds from sale of assets directly. Proceeds must go to NRO |

Cannot receive proceeds from sale of assets | Can receive proceeds from sale of foreign assets held before returning |

| Taxation | TDS applies to Indian income | Generally no tax on foreign income, tax applies to specific Indian income |

Interest earned is tax-free in India | Interest is taxable at slab in India |

| Currency | INR and Foreign currency | Foreign currency | Foreign currency | Foreign currency |

An NRE account can be opened only once you are an NRI as a fresh account. Old accounts, which existed when you were a resident Indian, must be converted into NRO accounts, not NRE accounts. You can check your NRI status here: Who is an NRI and who is not? Understanding FEMA and NRE/NRO bank accounts.

This account is used to send money to India. The features and uses are:

This account is used for any income and investments in India. The features and uses are:

Note: FCNR(A) accounts were discontinued in 1993 and used to have exchange rate guarantee from the RBI. Now only FCNR(B) accounts, without exchange rate guarantees, exist.

Resident Foreign Currency (RFC) are for NRIs who have returned to India and used to store foreign currency, say in USD, GBP and EUR

Read more about RFC accounts here: How Returning NRIs can Preserve Forex and Save Taxes via RFC accounts?

This table summarises NRE, NRO, FCNR and RFC account types for every type of tax status:

| Account Type | NRI | RNOR | Resident (ROR) |

|---|---|---|---|

| NRE | Open & Operate | Can Continue (if not yet reclassified) New not allowed |

Must be converted to Resident Account |

| NRO | Open & Operate | Continue as-is | Continue as-is |

| RFC | Cannot open | Can Open & Operate | Can Continue / No tax benefits |

| FCNR (B) | Open & Operate | Cannot open new Continue till maturity |

No new deposits Continue till maturity → must convert |

Here it is important to understand how FEMA and Income Tax Acts serve different purposes for NRIs.

| Feature | FEMA | Income Tax Act |

|---|---|---|

| Governs | Bank accounts, remittances, investments | Global income taxation, exemptions |

| Test | Intent + stay | Physical presence (≥182 days) |

| RNOR concept | Not defined | Defined for 2-3 FYs |

| Consequences | Affects repatriability, account type eligibility |

Affects tax on foreign income/assets |

| Authority | RBI (via FEMA rules) | Central Board of Direct Taxes (CBDT) |

To be on the safe side, you should track the following:

| Scenario | FEMA Residency (for bank accounts, remittances, investments) |

Income Tax Residency (for taxation of income) |

Implication |

|---|---|---|---|

| NRI returns to India on short visit / sabbatical / family matter (intent to go back abroad) |

Still treated as NRI under FEMA | May become Resident (RNOR) or even ROR if >182 days stay |

Can retain NRE/FCNR/RFC; but foreign income taxable if IT status is Resident |

| NRI returns, closes job abroad but delays formal reclassification |

Treated as Resident under FEMA (intent implies permanent return) |

Likely Resident (ROR) after 2-3 FYs | Must convert NRE/FCNR; foreign income taxable |

| NRI returns but keeps foreign employment active (e.g., remote work, paid abroad) |

Can be NRI under FEMA | May become Resident under IT Act if >182 days in India |

Accounts can remain as NRE/FCNR; but tax on foreign salary may apply if received in India |

| NRI returns with clear long-term return intent (buys house, joins Indian job) |

Resident under FEMA immediately | RNOR for up to 2-3 years, then ROR |

All foreign income taxable after RNOR ends; must reclassify accounts |

| Stays less than 182 days in India during FY | NRI under FEMA | NRI under IT Act | No change needed; tax-free foreign income and accounts continue as-is |

RBI Circular titled Accounts in India by Non-residents, dated 16-Jan-2025 says

Source: https://www.rbi.org.in/commonman/Upload/English/FAQs/PDFs/Accountresidents16012025.pdf

Therefore the responsibility lies with the returning NRI to inform their bank(s) immediately of a change in residential status.

| Event | Timeline (Expected) | Action Required |

|---|---|---|

| Arrival in India for permanent return | Immediately (Within 30 days) |

Inform banks of change in residential status (NRI ➝ Resident) |

| FCNR/NRE/NRO Reclassification |

Typically within 3 months | Banks expect re-declaration of residency and initiate reclassification |

| Conversion of NRE ➝ Resident Account | At earliest of: - On maturity of deposit - Or on request from customer post-status update |

Can continue NRE till maturity if status declared; must not renew as NRE |

| FCNR Account | Same as above | Can be held till maturity; no new deposits allowed |

You have the option to convert the maturing FCNR proceeds into an RFC account to maintain forex exposure. You can do the same with NRE also with in implicit currency conversion happening since NRE is in INR while RFC is in foreign currency.

Important: Failure to inform the bank does not defer the change in tax status. The Income Tax Act applies independently of FEMA. Even if you don’t inform your bank, your NRE/FCNR interest becomes taxable in India once you become ROR.

Once you are back in India, please follow these steps:

We will now deal with the scenario where your stay in India is uncertain and you may go back abroad soon.

Under FEMA, residency is defined by intent and duration:

So, if someone returns to India but:

…then FEMA may still consider them NRI, and they can delay reclassification of accounts accordingly.

Note: Students leaving India for higher studies are considered NRIs from the day they fly out.

| Event | Condition | Action |

|---|---|---|

| Return to India | With clear intent to re-emigrate, or no final settlement (e.g., sabbatical, job transition) |

Can retain NRE/FCNR status for the interim; no immediate reclassification needed |

| Stay exceeds 182 days + employment/job ends abroad |

Increasing indication of permanent return | Banks may start questioning status; recommended to reclassify or provide justification |

| Stay exceeds ~1 year without re-emigration or other related criteria |

Implicit change in FEMA status | Must reclassify accounts; risk of FEMA non-compliance increases |

| Tax Status | Irrespective of FEMA status | Income Tax residency will change to RNOR/ROR, triggering taxation of global income |

| Document | Use |

|---|---|

| Passport with entry/exit stamps | Proof of stay for IT Act |

| Visa/Employment documents | FEMA intent evidence |

| Bank status change letters | For future audit/tracking |

| FATCA/CRS self-declarations | Mutual funds and bank KYC |

| RNOR computation table | Tax return documentation |

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Returning to India? What to do with your NRE and NRO accounts and by when? first appeared on 27 Apr 2025 at https://arthgyaan.com