Advance Tax: Who Needs to Pay and not Pay, Deadlines and Penalties Explained

If your estimated tax liability exceeds ₹10,000 after TDS/TCS, you must pay advance tax as per the schedule to avoid penalties.

If your estimated tax liability exceeds ₹10,000 after TDS/TCS, you must pay advance tax as per the schedule to avoid penalties.

When can I avoid paying advance tax?

You must pay advance tax if your total tax liability (after deducting Tax Deducted at Source (TDS) like from salary or FD interest and Tax Collected at Source (TCS)) is likely to exceed ₹10,000 in a financial year (April to March). If it does not exceed ₹10,000 then you can skip paying advance tax.

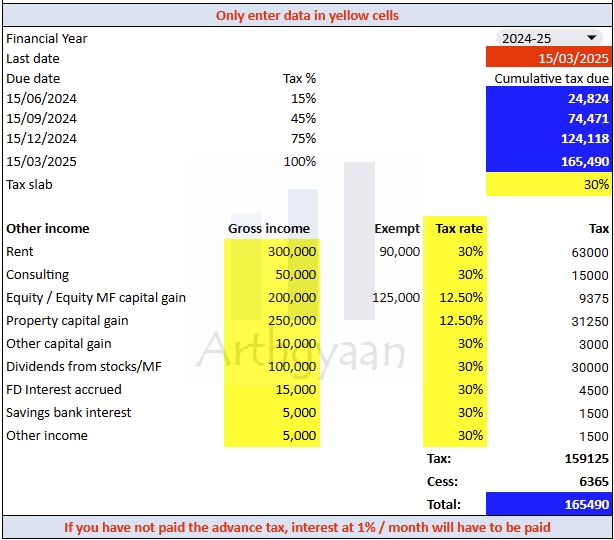

We have a free calculator to help you find out.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the advance-tax tab of the sheet once you open it.

For the FAQs below, please use the Find feature of your browser to look for specific questions and answers.

Advance tax is a system where taxpayers pay their income tax in installments throughout the financial year instead of a lump sum at the end. It helps the government maintain a steady flow of revenue and prevents taxpayers from facing a large tax burden or penalties for late payment.

Advance tax is must be paid by 15th March.

Advance tax must be paid by salaried employees, self-employed professionals, and business owners if their estimated tax liability exceeds ₹10,000 after deducting TDS/TCS. Senior citizens without business income are exempt. Small businesses and professionals under Sections 44AD & 44ADA have special rules.

For regular taxpayers: by 15th June: 15% of total tax due, by 15th September: 45% of total tax due (after previous payments), by 15th December: 75% of total tax due (after previous payments) and by 15th March: 100% of total tax due (after previous payments). For presumptive taxation scheme (Sections 44AD & 44ADA): 15th March: 100% of tax due

Estimate total income from all sources, deduct exemptions and deductions, apply income tax slab rates, and subtract TDS/TCS. If the remaining tax liability is more than ₹10,000, advance tax must be paid.

Salary already has TDS from the company and therefore does not come under advance tax. But other incomes that might be missed for advance tax are dividend (only 10% TDS if above ₹5000/company), interest, rental income, consultancy and of course capital gains tax.

Visit the Income Tax Department’s e-filing portal (www.incometax.gov.in), go to ‘e-Pay Tax’, enter PAN details, select ‘Income Tax’ > ‘Advance Tax (100)’, choose the correct assessment year (2025-26), enter tax amount, select payment mode, and complete the transaction. Save the challan receipt for reference.

Interest under Sections 234B and 234C will be charged. Section 234B applies if less than 90% of tax liability is paid by 31st March, and Section 234C applies for late installment payments. Interest is 1% per month.

Yes, but it will attract interest under Sections 234B and 234C. To avoid penalties, advance tax should be paid on time.

If advance tax paid is higher than the final tax liability, the excess amount will be refunded by the Income Tax Department. Taxpayers can track refunds through the e-filing portal, and the earlier you file returns, the earlier you will get the refund.

Advance tax is a system where taxpayers pay their income tax in installments throughout the financial year instead of a lump sum at the end. It helps the government maintain a steady flow of revenue and prevents taxpayers from facing a large tax burden or penalties for late payment.

Advance tax is must be paid by 15th March.

Advance tax must be paid by salaried employees, self-employed professionals, and business owners if their estimated tax liability exceeds ₹10,000 after deducting TDS/TCS. Senior citizens without business income are exempt. Small businesses and professionals under Sections 44AD & 44ADA have special rules.

For regular taxpayers: by 15th June: 15% of total tax due, by 15th September: 45% of total tax due (after previous payments), by 15th December: 75% of total tax due (after previous payments) and by 15th March: 100% of total tax due (after previous payments). For presumptive taxation scheme (Sections 44AD & 44ADA): 15th March: 100% of tax due

Estimate total income from all sources, deduct exemptions and deductions, apply income tax slab rates, and subtract TDS/TCS. If the remaining tax liability is more than ₹10,000, advance tax must be paid.

Salary already has TDS from the company and therefore does not come under advance tax. But other incomes that might be missed for advance tax are dividend (only 10% TDS if above ₹5000/company), interest, rental income, consultancy and of course capital gains tax.

Visit the Income Tax Department's e-filing portal (www.incometax.gov.in), go to 'e-Pay Tax', enter PAN details, select 'Income Tax' > 'Advance Tax (100)', choose the correct assessment year (2025-26), enter tax amount, select payment mode, and complete the transaction. Save the challan receipt for reference.

Interest under Sections 234B and 234C will be charged. Section 234B applies if less than 90% of tax liability is paid by 31st March, and Section 234C applies for late installment payments. Interest is 1% per month.

Yes, but it will attract interest under Sections 234B and 234C. To avoid penalties, advance tax should be paid on time.

If advance tax paid is higher than the final tax liability, the excess amount will be refunded by the Income Tax Department. Taxpayers can track refunds through the e-filing portal, and the earlier you file returns, the earlier you will get the refund.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Advance Tax: Who Needs to Pay and not Pay, Deadlines and Penalties Explained first appeared on 14 Mar 2025 at https://arthgyaan.com