Latest article

Tax

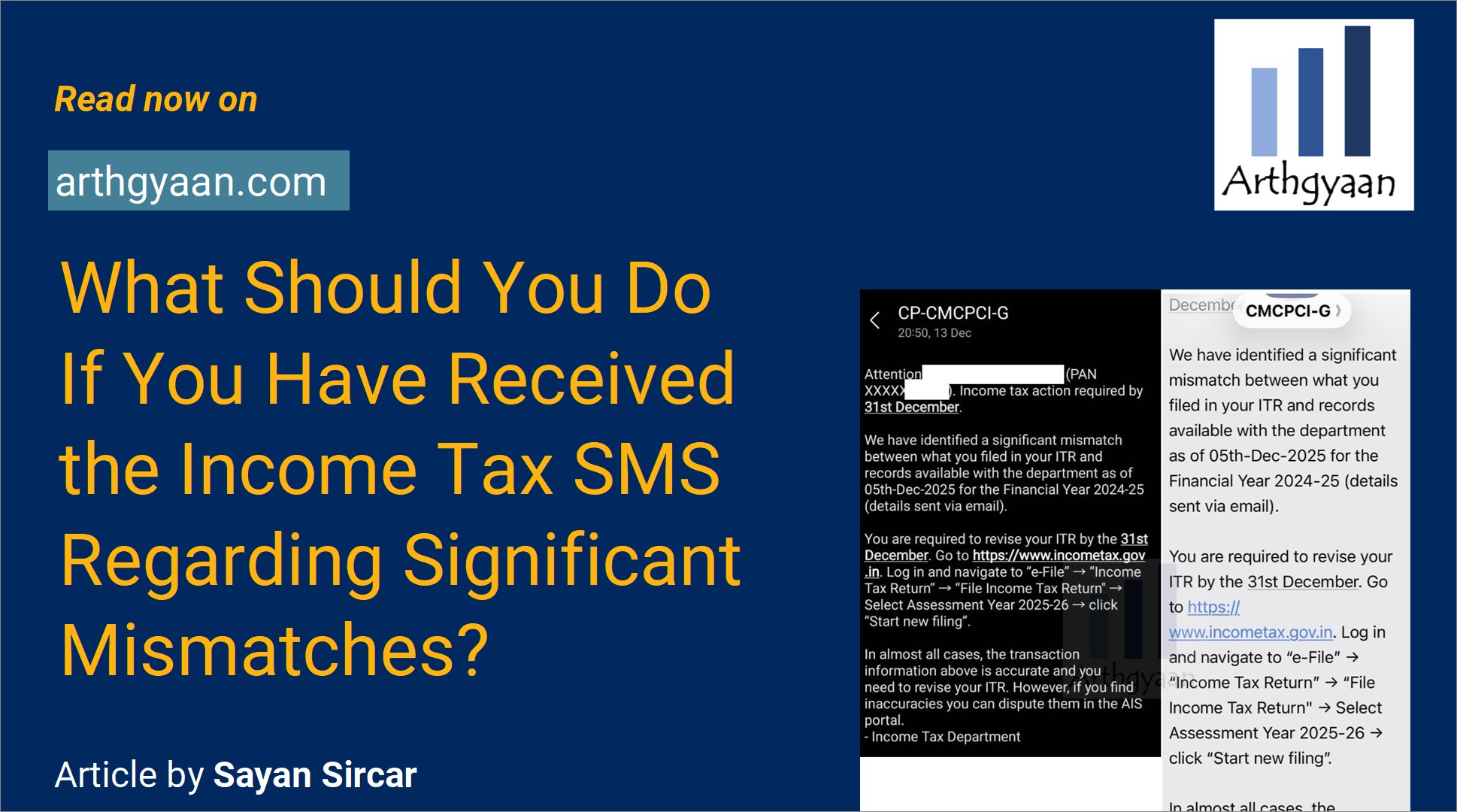

What Should You Do If You Have Received the Income Tax Email Regarding Data Has Been Shared by a Foreign Jurisdiction or the USA authorities?

Article: This article outlines the next steps for taxpayers who receive an email or SMS regarding missed or incomplete Schedule FA, based on FATCA/CRS data-sharing agreements.

Published: 18 December 2025

14 MIN READ

Explore Mutual Fund Packages

Create your own goal-based investing plan

Popular posts

-

A complete history of gold prices in India since the 1950s

This article provides a reference list of gold prices in India every year since 1950. -

Case study: how this double income single kid family can perform DIY goal-based investment planning

This article shows how a very typical salaried couple with one child can invest for future goals using the Arthgyaan goal-based investing tool. -

How much money can NRIs gift to parents in India?

This article covers the mechanics for NRIs to regularly send or make one-time large gifts of money to parents in India. -

Should US-based NRIs sell off their mutual funds and stocks in India?

This article makes US-based NRIs aware of the taxation on the unrealised gain rule if they invest in Indian stocks, ETFs and mutual funds. -

Frequently asked questions (FAQs) on Tax Collected at Source (TCS) when you buy a car

This article gives you a list of common questions and their answers on the concept of tax collected at source when you buy a car.