Products

-

Single goal Calculator

Simple calculator that allows you to find out SIP amounts for goals like retirement, children's education/marriage, car purchase, foreign vacations, house downpayment etc.

Simple calculator that allows you to find out SIP amounts for goals like retirement, children’s education/marriage, car purchase, foreign vacations, house downpayment etc. You will be able to get your SIP allocation and the amount to be invested monthly.

The calculator shows your SIP amount for goals like

- Single payment: car purchase, foreign vacation, house downpayment etc.

- Multipayment goals like college education

- Children’s goal planning from school to marriage

- Traditional retirement from 58-60

- Early retirement to support FIRE from an age of your choice

Once you have decided on the asset allocation and SIP amounts, read this article to learn how to choose funds to invest in.

Here is the link: Click here

Note: This is free content made available on site https://arthgyaan.com.

-

Atomic Essays

30 essential personal finance concepts in an easy-to-read format

Atomic essays are short posts around 250-300 words that are easy to read and understand. In this collection of 30 essays, Sayan Sircar covers a variety of personal finance, goal-based investing, portfolio construction and risk management topics.

Some of the topics covered include

- managing retirement

- best way to pay off loans

- role of risk in portfolios

- investing in SIP or lumpsum

- goal setting before investing

- should you invest in index funds?

- managing your budget and having an emergency fund

- tracking return of your investments and managing risk

- how to avoid common mistakes in choosing mutual funds

- and many more…

Here is the link: Click here

Note: This is free content made available on site https://arthgyaan.com.

-

Goal-based Investing Template

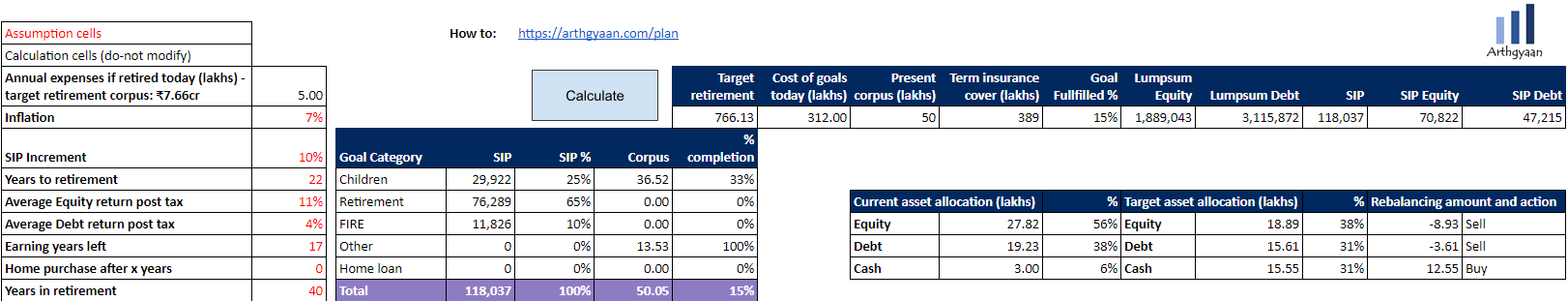

Excel workbook that allows you to find out your asset allocation, SIP amount and rebalancing plan.

The plan is an Excel workbook that allows you to find out your goal-wise asset allocation, SIP amount and rebalancing plan.

The workbook can handle goals like:

- Single payment: car purchase, foreign vacation, house downpayment etc.

- Multipayment goals like college education

- Children’s goal planning from school to marriage

- Traditional retirement from 58-60

- Early retirement to support FIRE from an age of your choice

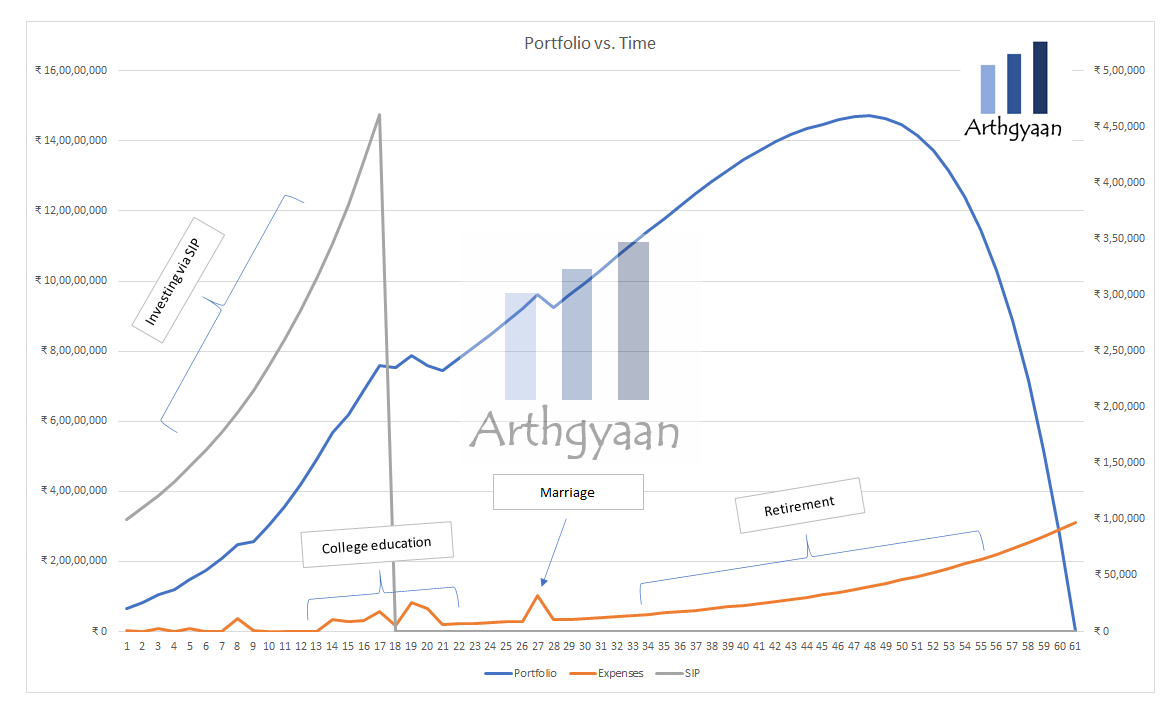

This is how a portfolio looks over time:

Once you have decided on the asset allocation and SIP amounts, read this article to learn how to choose funds to invest in.

Here is the link: Click here

Note: This is free content made available on site https://arthgyaan.com.

-

Risk Profiler Tool

Risk profiling is a mandatory step that should be completed before investing in goals.

A portfolio created for a goal has one purpose: to meet the goal. Therefore, we need to balance risky assets that generally appreciate fast (like equity) and slow-growing assets that provide stability (like debt). The tool that is used to determine this mix of investments is risk profiling.

The calculator determines your risk taking willingness vs. risk taking ability and recommends an appropriate asset allocation for a specific goal. The approach is detailed in this post.

Here is the link: Click here

Note: This is free content made available on site https://arthgyaan.com.